On (ONON) stock took off on Wednesday after the Swiss-based sportswear company announced results from its Q3 2025 earnings report. The company performed well during the quarter, which resulted in adjusted EPS and revenue above estimates. Additionally, adjusted EPS and revenue both experienced strong year-over-year gains.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This strong performance led On to increase its guidance for the full year of 2025. The company now expects revenue to increase 34% year-over-year, up from its prior outlook of 31%. This should result in revenue of CHF 2.98 billion, compared to its previous guidance of CHF 2.91 billion. On also expects a gross profit margin of 62.5%, up from its prior estimate of 60.5% to 61%, and an adjusted EBITDA margin of 18%, an increase from its previous outlook of 17% to 17.5%.

Martin Hoffmann, CEO and Chief Financial Officer of On, said, “At the core, our focus on operational excellence and technology is making us faster, smarter, and more agile. These results give us strong confidence – both for a successful holiday season and for the long term, as we continue building the world’s most premium global sportswear brand.”

On Stock Movement Today

On stock was up 24.22% on Wednesday, following a 0.63% gain yesterday. The shares were down 35.77% year-to-date and 33.26% over the past 12 months.

Trading activity is heavy today, as some 6.9 million shares changed hands. That’s up from ONON stock’s three-month daily average trading volume of about 5.93 million units.

Is On Stock a Buy, Sell, or Hold?

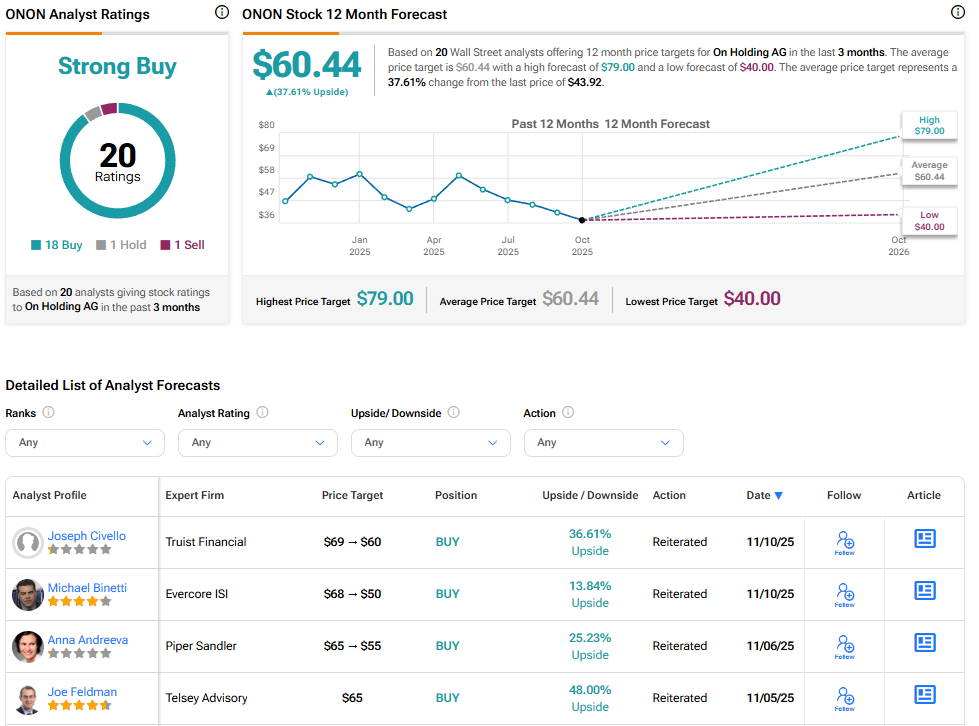

Turning to Wall Street, the analysts’ consensus rating for On is Strong Buy, based on 18 Buy, one Hold, and a single Sell rating over the past three months. With that comes an average ONON stock price target of $60.44, representing a potential 37.61% upside for the shares. These ratings and price targets will likely change as analysts update their coverage after today’s earnings report.