Old National Bancorp (ONB) and First Midwest Bancorp, Inc. (FMBI) have agreed to merge in an all-stock merger of equals. The combined entity, with an expected market value of $6.5 billion will have assets worth $45 billion and $34 billion in deposits and will create a premier Midwestern bank. Shares of First Midwest rose 1.1%, while Old National shares fell 1.7% on June 1.

The new entity will function under Old National Bancorp and Old National Bank names, with dual headquarters in Evansville, Indiana, and Chicago, Illinois. The deal is expected to be accretive to both banks in 2022, with GAAP EPS accretion of around 22% to ONB and 35% to FMBI.

Per the terms of the agreement, shareholders of First Midwest will receive 1.1336 shares of Old National common stock for each share held. The deal, which is approved by the Boards of both banks, is likely to close in late 2021 or early 2022, subject to certain regulatory approvals.

Upon closure of the deal, existing First Midwest shareholders are expected to own around 44% of the new entity. (See Old National stock analysis on TipRanks)

Commenting on the deal, Old National Chairman and CEO Jim Ryan said, “We are confident that the powerful synergies, additional market coverage and financial strength this partnership creates will drive long-term shareholder value, and we are excited about combining the outstanding legacies of two strong, client- and community-focused organizations.”

On April 19, Old National reported Q1 earnings of $0.52 per share, beating the Street’s estimates of $0.41 per share. Total revenue came in at $208.33 million, missing analysts’ expectations of $208.82 million.

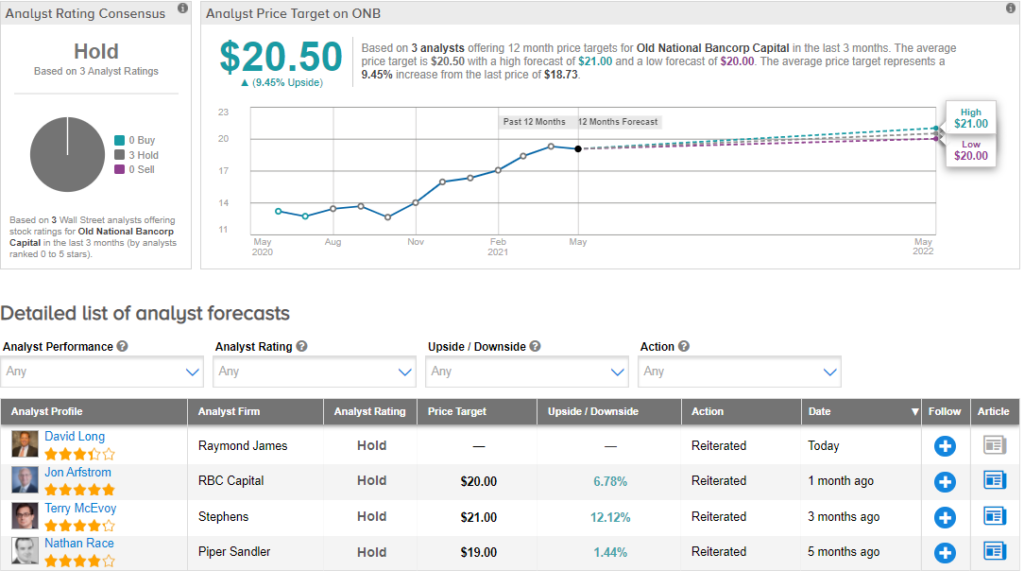

Following the results, RBC Capital analyst Jon Arfstrom reiterated a Hold rating on the stock with a price target of $20 implying 6.8% upside potential.

The stock has a Hold consensus rating based on 3 Holds. The average analyst price target of $20.50 implies 9.5% upside potential from current levels.

Related News:

Esports Entertainment Signs Multi-Year Deal as LAFC’s Esports Tournament Platform Provider

NIO Vehicle Deliveries Fall 5.5% in May; Street Remains Bullish

Canopy Growth Posts 38% Revenue Growth in Q4, Miss Estimates; Shares Fall 1%