The benchmark crude WTI gained 1.88% to settle at $79.86. The latest CPI print indicated inflation eased for a third consecutive month, and oil has put on quick gains, inching closer to the $80 mark.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Markets are now largely expecting improving Chinese demand for oil and a 0.25% rate hike from the U.S. Fed early next month. It would be quite some time, though, before the central bank completely takes its foot off the pedal after an aggressive stance in 2022.

Importantly, energy and gasoline prices played a major factor in the easing of inflation for December. Any strong uptick in prices could unseat current inflation trends faster in the next CPI print.

Meanwhile, natural gas fell by 7.47% to close at $3.419. The latest numbers from the Energy Information Administration indicate natural gas inventories in the U.S. increased by 11 BCF to 2,902 BCF during the first week of 2023. The Energy Select Sector SPDR ETF (XLE) is up 3.4% so far this month.

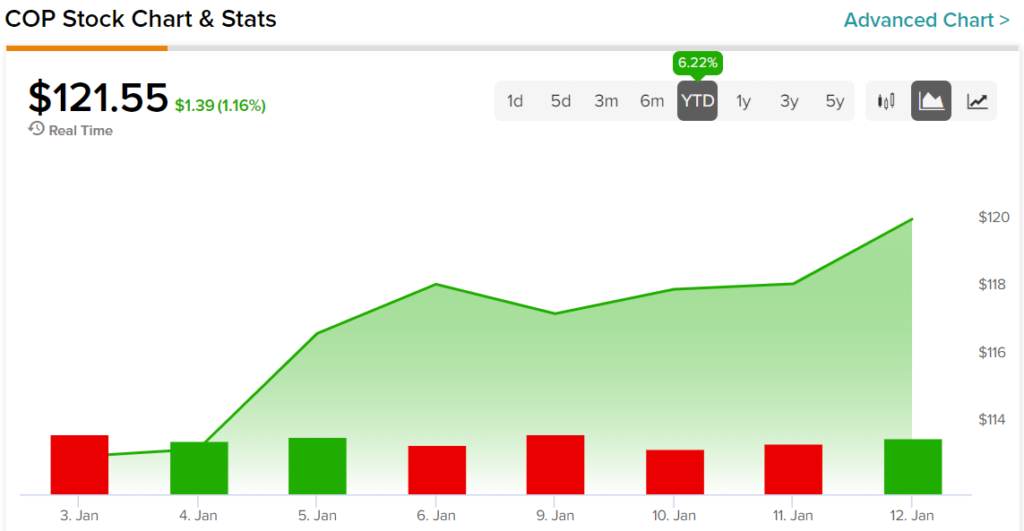

Elsewhere, ConocoPhillips (NYSE:COP) is mulling a deal with Petroleos de Venezuela SA (PdVSA) in order to sell Venezuelan oil in the U.S. on behalf of PdVSA. COP shares have already climbed about 6.2% so far this month.

Here are related tickers for this article:

- United States Oil Fund LP (USO)

- Exxon (XOM)

- Frontline (FRO)

- ProShares Ultra Bloomberg Crude Oil (UCO)

- United States Natural Gas Fund LP (UNG)

- Cheniere Energy (LNG)

- ConocoPhillips (COP)

- Chevron (CVX)

- Bloom energy (BE)

- Occidental Petroleum (OXY)

Read full Disclosure