NXP Semiconductors (NXPI) is a Dutch global semiconductor manufacturer. Its chips support a wide range of applications, from automotive to wireless infrastructure.

For Q4 2021, the company reported a 21% year-over-year jump in revenue to $3 billion, matching the consensus estimate. It posted EPS of $2.24, which improved from $1.08 in the same quarter the previous year but missed the consensus estimate of $2.99.

NXP Semiconductors ended the quarter with $2.8 billion in cash and cash equivalents. It plans to distribute a quarterly dividend of $0.85 per share on April 6 to shareholders of record on March 15. NXPI stock currently offers a dividend yield of 1.37%, compared to the sector average of 0.69%.

The company has boosted its share repurchase program by $2 billion, adding to the approximately $1.4 billion remaining under the previous authorization.

With this in mind, we used TipRanks to take a look at the newly added risk factors for NXP Semiconductors.

Risk Factors

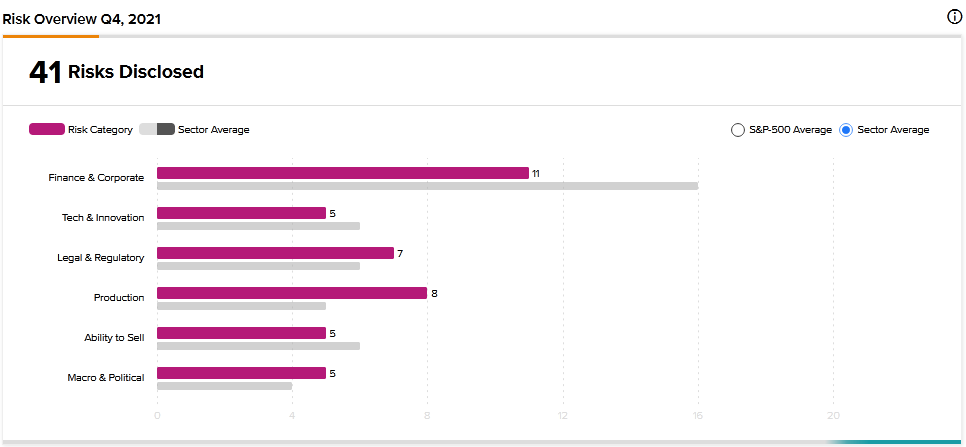

According to the new TipRanks Risk Factors tool, NXP Semiconductors’ main risk category is Finance and Corporate, with 11 of the total 41 risks identified for the stock. Production and Legal and Regulatory are the next two major risk categories with 8 and 7 risks, respectively. The company has recently updated its profile with three new risk factors.

In a newly added Finance and Corporate risk factor, NXP Semiconductors informs investors that it recently discovered a material weakness in its internal controls, specifically, in its IT systems that support financial reporting processes. It has already started working on addressing the issue. However, it cautions that if its efforts to fix the problem fail, its ability to report financial information accurately could be adversely affected.

The company warns that delivering inaccurate reports could cause investors to lose confidence in its financial statements. Moreover, the company could face lawsuits and regulatory probes that could increase its costs and adversely affect its stock price.

In a newly added Legal and Regulatory risk factor, NXP Semiconductors tells investors that it is subject to complex regulations. It mentions health and safety requirements at its facilities and regulations over the environmental impact of its operations. For example, the company could be exposed to liabilities related to the handling of factory waste. Additionally, there are greenhouse gas emission reduction requirements. Therefore, NXP Semiconductors warns that its operating results and financial condition could be harmed as it works to comply with the complex and changing regulations.

NXP Semiconductors’ newly added Tech and Innovation risk factor addresses the security vulnerabilities of its products. The company explains that it regularly finds security vulnerabilities in its products and works to address them. It cautions that if third parties identify vulnerabilities in its products before mitigating actions can be taken, the vulnerabilities could be exploited, which could adversely affect the demand for its products and harm its business and reputation.

Analysts’ Take

Truist analyst William Stein recently maintained a Buy rating on NXP Semiconductors stock and raised the price target to $265 from $250. Stein’s new price target suggests 36.46% upside potential.

Consensus among analysts is a Moderate Buy based on 10 Buys, 7 Holds, and 1 Sell. The average NXP Semiconductors price target of $245 implies 26.16% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Cinemark Holdings’ Q4 Results Exceed Expectations

LendingTree Rises 15.7% Despite Mixed Q4 Results

NOV, Inc. Updates 1 Key Risk Factor