Nvidia’s proposed $40 billion acquisition of Cambridge-based Arm is in trouble. On Monday, the UK’s Secretary of State issued an intervention notice on behalf of the UK Government citing national security interests.

In September 2020, the $40 billion acquisition of Arm from the SoftBank Group was presented by Nvidia (NVDA) with the intention of building an artificial intelligence (AI) supercomputer powered by the two companies. The deal would allow Arm to expand its intellectual property (IP) licensing portfolio using Nvidia technology. Arm has shipped over 180 billion microprocessor chips to-date.

The UK Government’s intervention notice stated, “Whereas the Secretary of State believes that it is or may be the case that a public interest consideration is relevant to a consideration of the relevant merger situation. Now, therefore, the Secretary of State in exercise of his powers under section 42(2) of the Act hereby gives this intervention notice.”

“The Secretary of State believes that it is or may be the case that the interests of national security, being a public interest consideration specified in section 58(1) of the Act, are relevant to a consideration of the relevant merger situation.”

The notice also asks UK’s Competition and Markets Authority to investigate the merger and compile a report by July 30. (See Nvidia stock analysis on TipRanks)

According to a CNBC report, UK’s Digital Secretary Oliver Dowden from the Department for Culture, Digital, Media and Sport said, “As a next step and to help me gather the relevant information, the U.K.’s independent competition authority will now prepare a report on the implications of the transaction, which will help inform any further decisions.”

Following the intervention notice, Rosenblatt Securities analyst Hans Mosesmann reiterated a Buy and a price target of $800 on the stock. Mosesmann said in a note to investors, “This intervention is a surprise to us, and given ARM’s headquarters and ancestral foundings in the U.K., it carries significant weight that could sway other key countries, including China, to also vote against or intervene against the deal.”

“Our own position has been that the deal was a 50-50 proposition, and given last week’s sudden announcement of Grace, Nvidia’s Plan B CPU roadmap without the ARM acquisition is on the table. We continue to like the Nvidia story and, despite this intervention, this does not deter against the longer term story of AI and accelerated computing being the path forward and the next cycle,” Mosesmann added.

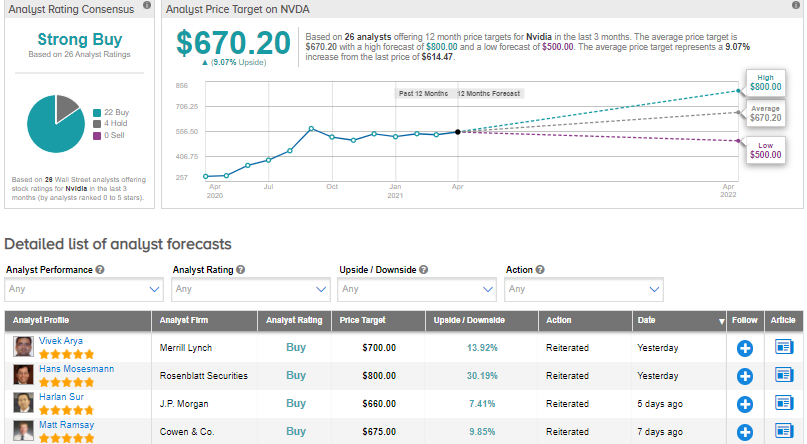

Meanwhile, Nvidia scores a Strong Buy consensus rating from the analyst community. That’s based on 22 analysts recommending a Buy and 4 analysts suggesting a Hold. The average analyst price target of $670.20 implies 9.1% upside potential to current levels.

Related News:

Alcoa Delivers Record 1Q Results As Higher Aluminum Prices Fuel Sales

Amazon Experiments With Furniture Assembly Service – Report

SeaSpine Holdings Prices 4.5M Public Offering At $19.50 Per Share