Nvidia stock gained after Foxconn reported strong AI server demand, reinforcing confidence that the global AI buildout continues to drive hardware orders ahead of Nvidia’s earnings next week.

Nvidia Stock Climbs the Foxconn Ladder on AI Server Growth

Story Highlights

Nvidia shares (NVDA) edged higher Wednesday after Foxconn Technology Group (HNHPF) reported strong demand for artificial intelligence hardware, giving investors another sign that the AI buildout remains in full swing ahead of Nvidia’s next earnings report.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The chipmaker’s stock rose about 1.6% in premarket trading to $196.24, reversing some of Tuesday’s losses after SoftBank (SFTBY) disclosed a $5.8 billion sale of Nvidia shares. The move comes just days before Nvidia reports quarterly results on Nov. 19, where investors will be watching closely for any signs that demand for its data center and AI products is still expanding.

Foxconn Expands Its AI Footprint

Foxconn, best known as Apple’s (AAPL) primary iPhone manufacturer, said Wednesday that cloud and networking products, including AI servers, now make up 42% of its total revenue. The segment has overtaken smart consumer electronics as the company’s largest business line for the second straight quarter.

The Taiwanese company reported cumulative AI server revenue of 1 trillion New Taiwan dollars (about $32.2 billion) as of the end of September. This growth has been fueled by global demand for Nvidia-powered systems used to train and run large AI models.

Foxconn’s results come amid growing partnerships between the two companies. The manufacturer has worked alongside Nvidia on several AI infrastructure projects, helping expand the production capacity needed to meet surging global demand for GPUs.

Nvidia Eyes Earnings Catalyst

The latest signal from Foxconn suggests Nvidia’s order pipeline remains strong despite recent volatility in its share price. The company’s data center business, now its largest source of revenue, has been the main driver of its record growth over the past year.

Analysts expect Nvidia’s upcoming report to confirm continued strength in AI server shipments, though some have warned of cooling momentum in consumer GPU sales. Still, reports of robust manufacturing demand from partners like Foxconn have helped reassure investors that the AI cycle remains intact.

Advanced Micro Devices (AMD) also rose on Wednesday, up more than 5%, after projecting annual revenue growth above 35% over the next three to five years, powered by demand for its own AI processors.

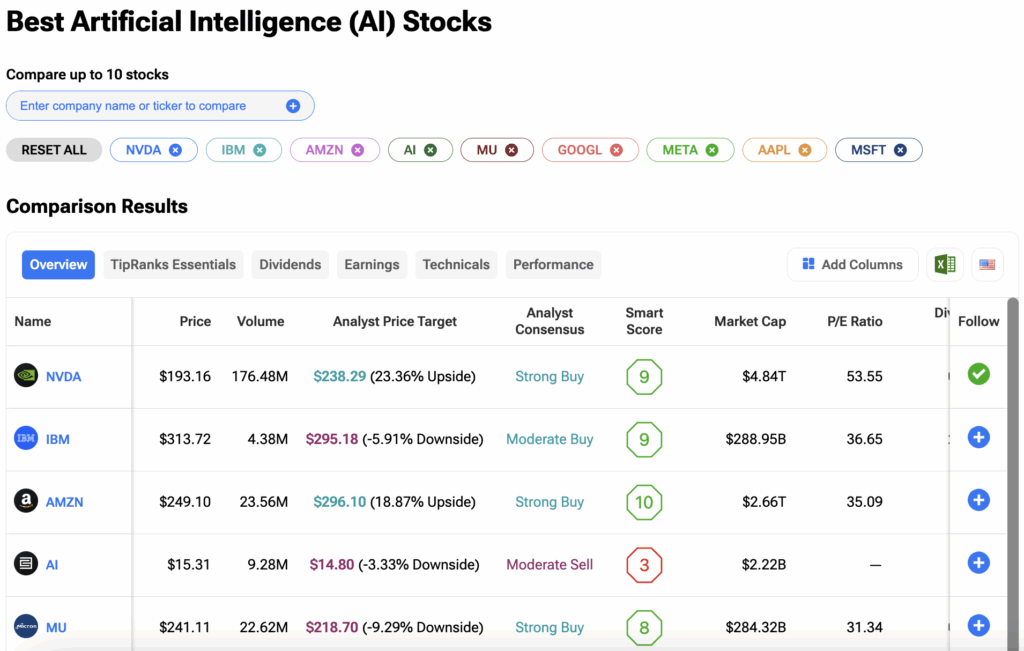

Investors can compare AI stocks side-by-side and filter results based on various financial metrics and analyst ratings on the TipRanks Stocks Comparison Tool. Click on the image below to find out more.

1