AI (Artificial Intelligence)-driven demand significantly boosted Nvidia’s (NASDAQ:NVDA) financials and share price in 2023, with the stock gaining about 247% year-to-date. However, investment firm Edgewater Research said channel data signals mixed near-term demand for NVDA’s AI GPUs (graphics processing units), raising concerns. As a result, NVDA stock closed about 1% lower on December 19.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While mixed data regarding NVDA’s AI GPU demand is worrisome, this doesn’t necessarily signify that demand is softening for the semiconductor giant’s GPUs. The equity research and market intelligence firm suggested that the introduction of the new chip, H200, might be a reason for this mixed-demand scenario. The firm believes that this chip is causing customers to temporarily halt their plans as they reevaluate its capabilities.

Notably, NVDA introduced the H200 GPU last month, featuring enhanced speed and a larger memory capacity designed to power the advancement of generative AI and large language models. Edgewater remains optimistic, interpreting the mixed data as a potential indication of a resurgence in demand around the middle of 2024. Moreover, the firm is bullish about the long-term prospects of NVDA’s data center business. With this backdrop, let’s look at the Street’s forecast for NVDA stock.

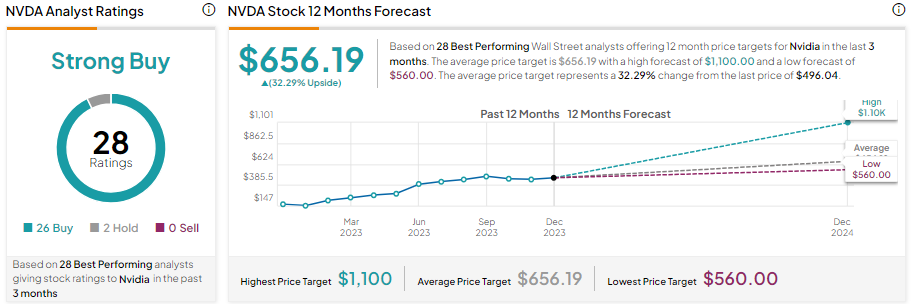

Is Nvidia Buy, Hold, or Sell?

While Nvidia stock has gained substantially year-to-date, analysts maintain a bullish outlook on its prospects. This suggests that analysts expect AI-led demand to sustain momentum in 2024.

Nvidia stock has 26 Buy and two Hold recommendations for a Strong Buy consensus rating. Moreover, analysts’ average price target of $656.19 implies 32.29% upside potential from current levels.