Chip stock Nvidia (NASDAQ:NVDA) likely knows that it’s at or near the top of the heap when it comes to making chips, particularly for artificial intelligence (AI) applications. And it gained fractionally in Wednesday afternoon’s trading despite having a harsh take on tap for anyone who thinks that chipmakers can get away from the China supply chain any time soon.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

So what was it Nvidia had to say that was so rough? While Nvidia—as expressed by CEO Jensen Huang—noted that getting away from the Chinese supply chain was an “absolutely” necessary effort for the sake of U.S. national security, it wasn’t likely to happen any time soon. By “any time soon,” here, Huang means “at least a decade.” In fact, it could take two or even more, as Huang stated, “total independence of supply chain is not a real practical thing for a decade or two.”

Huang also described the horns of the dilemma most chip stocks face right now, saying, “We’re a company that was built for business and so we try to do business with everybody we can. On the other hand, our national security matters and our national competitiveness matters.”

Are the Wheels Coming Off?

Nvidia’s rise has been amazing, but there are some disturbing signs ahead. For instance, Huang asserted that, within a period of “the next five years,” there would be an artificial general intelligence (AGI) that has roughly the same intelligence as a human being. That depends on how you define a few terms, but the key takeaway is that AI is evolving rapidly — perhaps even too rapidly for some tastes.

Meanwhile, there are signs that even the broader market is getting skeptical over just how much progress Nvidia can make in the market. Investors are questioning if the market is wrong, and some are even making plans accordingly.

Is Nvidia Stock a Good Buy Right Now?

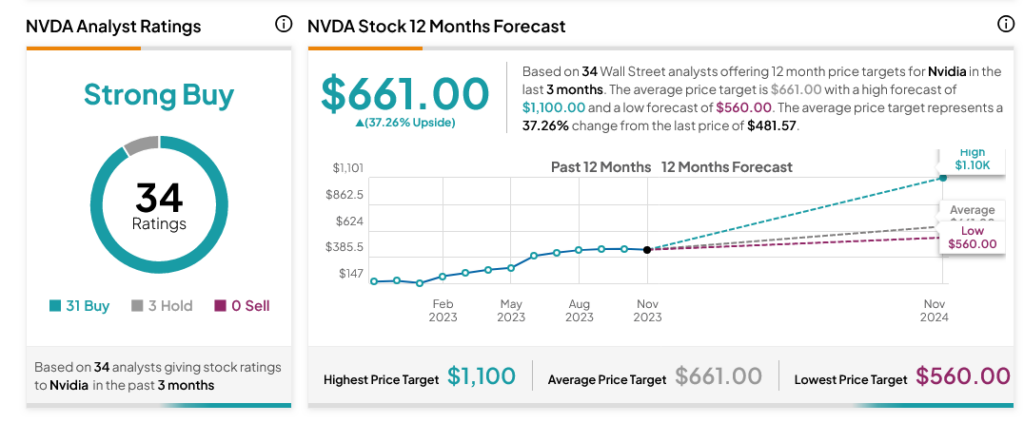

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 31 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 184.81% rally in its share price over the past year, the average NVDA price target of $661 per share implies 37.26% upside potential.