Shares of Nvidia (NASDAQ:NVDA) are down today despite analyst praise. Indeed, Goldman Sachs, led by Toshiya Hari, kept their Buy rating on the stock and raised the price target from $440 to $495 per share. The analysts believe artificial intelligence holds the potential to significantly enhance Nvidia’s performance.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Nvidia had earlier predicted a surge in demand for their data center chips, which are instrumental in running generative AI tech. Goldman Sachs analysts see this “step-change” in projected chip demand as indicative of Nvidia being poised for a growth spurt driven by the “rise and spread of generative AI.” Consequently, they have increased their predictions for Nvidia’s revenue and non-GAAP earnings per share for the fiscal years 2025-2026, citing significant growth potential for Nvidia’s data center business.

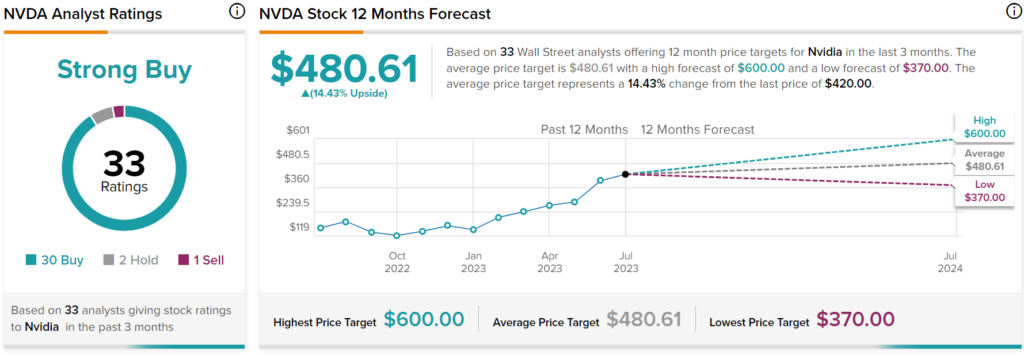

What is NVDA Stock’s Price Target?

Overall, analysts have a Strong Buy consensus rating on NVDA stock based on 30 Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic above. Furthermore, the average price target of $480.61 per share implies 14.43% upside potential.