Investor Michael Burry, whose bet against the subprime housing market was profiled in the book and film “The Big Short,” continues to sound the alarm about a new bubble in artificial intelligence (AI) stocks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

After being absent from social media for several years, Burry has returned with gusto. Since the end of October this year, the closely followed investor has revealed large short positions in leading AI technology stocks Nvidia (NVDA) and Palantir (PLTR) and criticized other players in the space such as Oracle (ORCL).

He has also accused U.S. technology companies of playing fast and loose with their accounting practices and warned that an AI bubble is likely to burst, taking down U.S. equity markets. In his first post, Burry wrote: “Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.”

Latest Comment

Now, in his latest social media post, Burry posted a picture of his character in The Big Short movie, played by actor Christian Bale, lying on the floor with sheets of paper strewn around him. The caption to the post reads: “Me then, me now. Oh well. It worked out. It will work out.”

The new social media post has been reposted 1,000 times and liked by nearly 10,000 followers on X/Twitter. It has also generated more than 9,500 comments from people. As is often the case, Burry’s post on social media was deleted by the investor shortly after it appeared.

Retail investors who treat Burry as a cult hero seem to agree that the message of the latest post is that the investor is confident in his prediction and that bubbles often take time to burst, whether the housing market in 2008 or AI today.

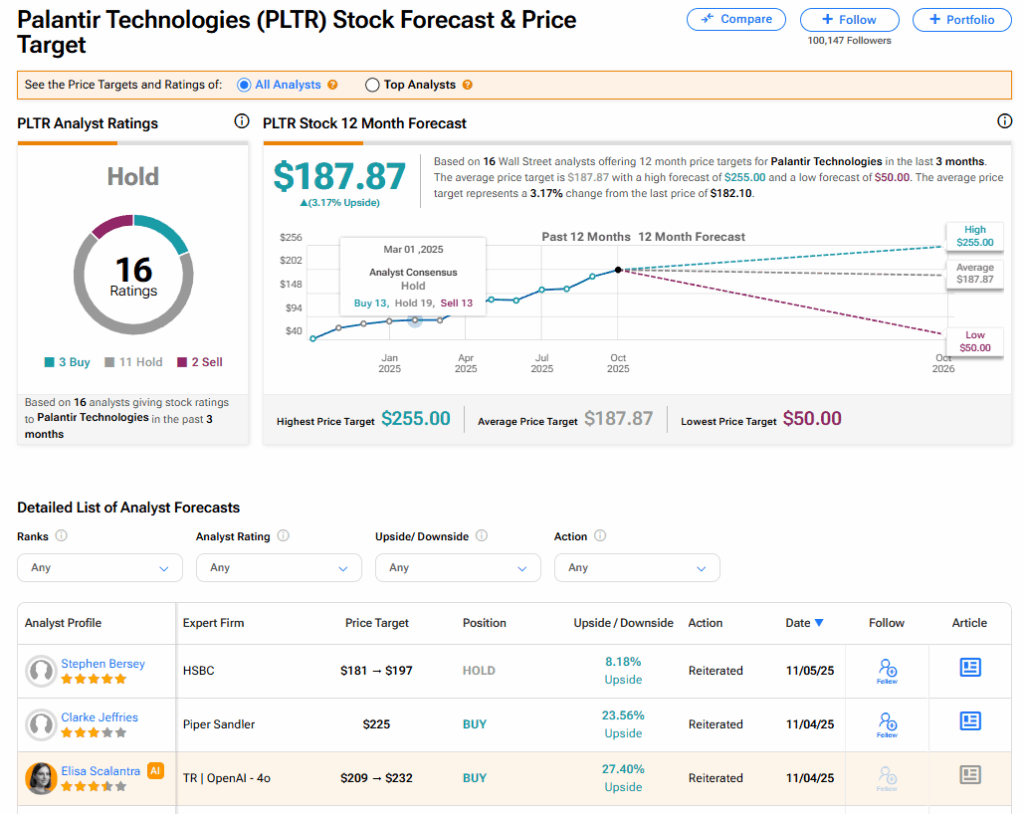

Is PLTR Stock a Buy?

The stock of Palantir has a consensus Hold rating among 16 Wall Street analysts. That rating is based on three Buy, 11 Hold, and two Sell recommendations issued in the last three months. The average PLTR price target of $187.87 implies 3.17% upside from current levels.