Nvidia (NVDA) and Advanced Micro Devices (AMD) continue to attract strong interest from U.S. active fund managers, according to a new report from Bank of America (BofA). Analysts led by Vivek Arya said Nvidia remains the most owned semiconductor stock, driven by its leading role in AI and data centers, while AMD’s ownership has also increased as investors bet on its growing role in AI and server chips.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nvidia Is Still the Most Owned Chip Stock

BofA’s October data showed that 76% of U.S. fund managers now own Nvidia, up 219 basis points from the prior quarter and 539 basis points from a year ago. This steady rise shows ongoing faith in the company.

Still, Nvidia’s portfolio weighting of 1.11x is only slightly higher than the 1.06x median among its top 16 tech and communication peers. BofA said this could mean some investors are taking profits after the stock’s big gains this year.

Notably, Nvidia will report third quarter of Fiscal 2026 on November 19. Wall Street projects earnings per share (EPS) of $1.25, up 54% year-over-year, with revenue expected to grow 56% to $54.6 billion.

AMD Ownership Rises but Still Underweight

Advanced Micro Devices (AMD) has seen a rise in ownership, climbing to 24% from 20% in July. However, this figure is still well below the 38% recorded a year ago. Despite its strong 2025 performance, BofA noted that AMD remains underweight in most portfolios, with a relative weighting of just 0.19x.

Meanwhile, AMD shares moved higher in premarket trading after the company held its 2025 Analyst Day on Tuesday. During the event, the chipmaker shared new growth targets and plans for its AI and data center business, which drew strong interest from investors.

Following the event, several analysts remained upbeat about the stock and raised their price targets, citing greater confidence in the company’s long-term earnings potential.

Investors Adjust Holdings in the Semiconductor Sector

Ownership gains were strongest in Synopsys (SNPS), which rose 466 basis points after its $35 billion Ansys deal, and in AMD, which increased 438 basis points. On the other hand, Qualcomm (QCOM), ON Semiconductor (ON), and Microchip Technology (MCHP) saw drops as demand for analog and industrial chips weakened.

BofA said the overall semiconductor sector weighting stands at 0.96x, slightly below December 2024 but higher than August levels, showing steady interest in chipmakers even as market swings continue.

Which Chip Stock Is the Best Buy?

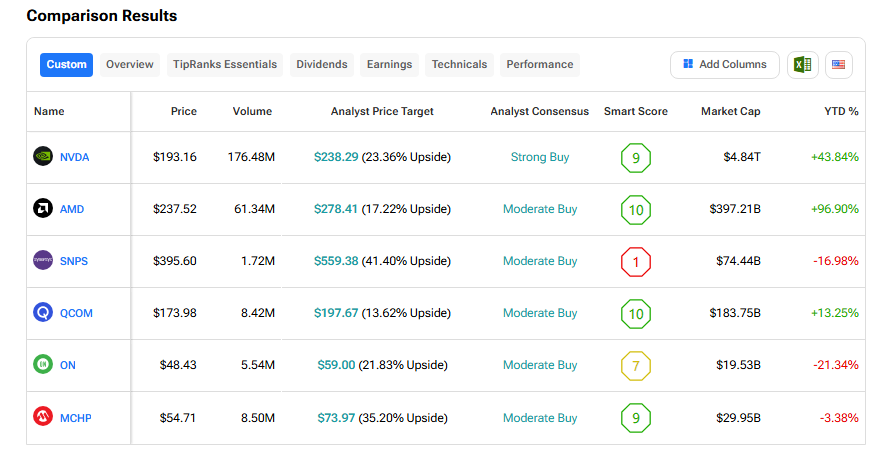

Turning to Wall Street, out of the six stocks mentioned above, Synopsys shows the highest upside at 41%, followed by Microchip at 35% and ON Semiconductor at 22%. Nvidia holds a Strong Buy rating with 23% upside, while AMD and Qualcomm are Moderate Buys with 17% and 14% upside, respectively.

Overall, analysts stay positive on the group, with Nvidia and Qualcomm earning top Smart Scores of 9 and 10.