Nutrien Ltd. delivered better-than-expected results in the fourth quarter as the crop inputs and services provider saw higher potash and nitrogen sales volumes and reduced production costs. Shares gained 3.8% in Wednesday’s after-market trading session.

Nutrien (NTR) posted earnings per share (EPS) of $0.24 during the fourth quarter, topping analysts’ expectations of $0.18. Revenue rose 17% year-on-year to $4.05 billion, beating analysts’ estimates of $3.52 billion. Fourth-quarter revenue growth was primarily attributable to the 22% increase in crop nutrient product sales and a 30% increase in crop protection product sales.

For fiscal 2020, the company generated sales of $20.91 billion, up from the $20.08 billion posted in 2019. Diluted earnings per share came in at $1.80.

Nutrien CEO Chuck Margo said, “Agriculture fundamentals began to improve in late 2020 and we are starting to see the benefit to our business from this cyclical recovery.”

Additionally, Nutrien ramped up its quarterly dividend to $0.46 per share from $0.45 earlier. This marks the company’s third consecutive dividend hike in the last three years. Furthermore, the company also approved a share repurchase plan of up to 5% of its outstanding shares over a period of one year.

Looking ahead to fiscal 2021, Nutrien sees EPS land between $2.05 to $2.75 and adjusted EBITDA to come in between $4 billion to $4.5 billion. (See Nutrien stock analysis on TipRanks)

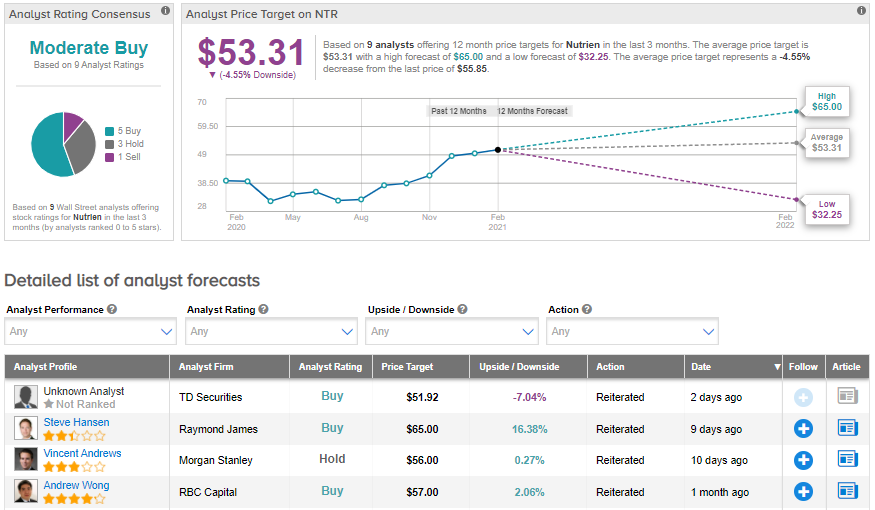

On Feb. 9 Raymond James analyst Steve Hansen raised Nutrien’s price target to $65 (16.4% upside potential) from $55 and reiterated a Buy rating. Hansen notes, the “robust, demand-driven surge” in global crop prices as “fundamentally constructive” for crop input demand and fertilizer prices.

The rest of the Street has a Moderate Buy consensus rating on the stock based on 5 Buys, 3 Holds and 1 Sell. The average analyst price target of $53.31 implies about 4.6% downside from current levels. That’s after the stock already gained about 37% over the past year.

Related News:

RingCentral’s 2021 Guidance Tops Estimates After 4Q Beat

T. Rowe Price Ramps Up Quarterly Dividend By 20%; Street Says Hold

Jack Henry Shores Up Quarterly Dividend By 7%; Street Sees 19% Upside