Nutanix (NTNX) reported a smaller-than-expected loss in the fiscal third quarter. Nutanix is a cloud computing company that sells software, cloud services, and software-defined storage.

The company incurred a loss of $0.41 per share in Q3, compared to the $0.49 loss per share estimated by analysts. A loss of $0.69 per share was reported in the same quarter last year.

Revenue generated in the quarter was $344.5 million which grew 8% from the year-ago period and outpaced analysts’ expectations of $334.5 million.

Annual Contract Value (ACV) billings were $159.9 million, up 18% year-over-year.

Nutanix’s CFO Duston Williams said, “Our growing renewals pipeline will help to drive future top line growth, offer substantial sales and marketing efficiencies, and increase the predictability in our business.” (See Nutanix stock analysis on TipRanks)

For the fourth quarter of Fiscal Year 2021, ACV billings are projected to be between $170 million and $175 million.

Following the fiscal Q3 earnings release, Susquehanna analyst Mehdi Hosseini increased the stock’s price target to $38.00 from $35.00 for 19.1% upside potential and reiterated a Buy rating.

Hosseini commented, “It is encouraging to see Nutanix continue to gain traction with AHV adoption, which has reached 52%, while ACV Billings continued to increase double digits Y/Y. We also expect cash burn to continue to moderate into FY22 with prospects of FCF BE by 4QFY22.”

Consensus among analysts is a Strong Buy based on 7 Buys versus 2 Holds. The average analyst price target stands at $41.13 and implies upside potential of 28.9% to current levels. Shares have gained 39.7% over the past year.

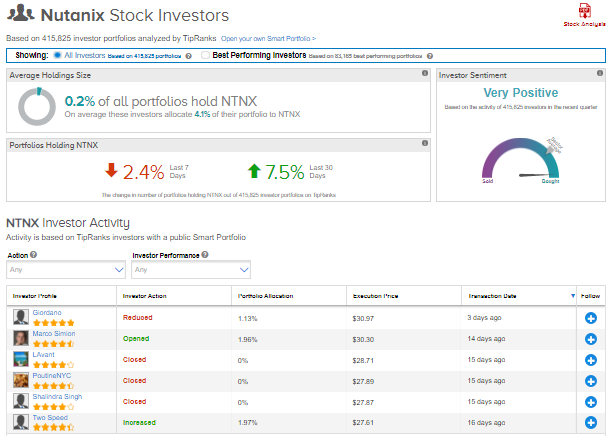

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Nutanix, with 7.5% of investors increasing their exposure to NTNX stock over the past 30 days.

Related News :

Workday Beats Analysts’ Expectations in Q1; Shares Down

Abercrombie & Fitch Delivers Strong Q1 Results; Shares Pop 8%

Garmin Expands Digital & Aviation Offerings with AeroData Buyout