Danish pharmaceutical major Novo Nordisk (NYSE:NVO) was on an upswing in pre-market trading after the manufacturer of weight loss drug, Wegovy, presented data at the American Heart Association Scientific Sessions underlining the benefits of the drug.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company presented results from its landmark phase 3 cardiovascular outcomes trial, SELECT, investigating the effects of once-weekly semaglutide 2.4 mg (Wegovy) in adults with established cardiovascular disease (CVD) and who are overweight or obese without diabetes.

This data indicated that Semaglutide or Wegovy 2.4mg resulted in a “statistically significant” reduction in risk of 20% in major adverse cardiovascular events (MACE). This risk reduction was across “age, gender, ethnicity and starting body mass index (BMI).”

The results of the SELECT trial also suggested that the “beneficial effects in MACE risk reduction were evident soon after treatment initiation” indicating a faster impact than expected solely through weight loss.

Last week, the company announced a $6 billion expansion of its manufacturing facilities in Kalundborg, Denmark.

Is Novo Nordisk a Buy, Sell, or Hold?

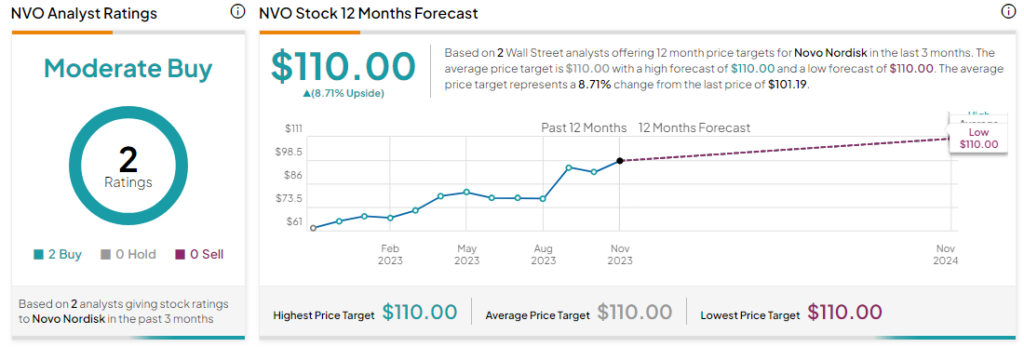

Analysts are cautiously optimistic about NVO stock with a Moderate Buy consensus rating based on two Buys. The average NVO price target of $110 implies an upside potential of 8.7% at current levels.