Shares of multidisciplinary primary healthcare services provider Novo Integrated Sciences (NVOS) jumped 7.4% on July 15 after the company announced its Q3 results.

Let’s take a look at its financial performance and what has changed in its key risk factors that investors should be aware of.

The easing of COVID-19 restrictions enabled Novo’s practitioners provide patients with additional in-person services in Q3. This helped the company register a 129.3% year-over-year jump in revenue to $2.38 million.

The operating expenses grew about 3x during this period to $1.68 million due to higher amortization costs and compensation expenses. This widened the net loss to $411.2 thousand against $98.3 thousand a year ago.

The company also made two acquisitions during the quarter. In June, it acquired Canada-based Acenzia, which provides nutraceutical health solutions. In May, it acquired U.S.-based PRO-DIP LLC, which has developed an oral pouch delivery system that has broader market applications in nutritional focused products as well as medicinal-based formulations. (See Novo Integrated stock chart on TipRanks)

Novo CEO and Board Chairman Robert Mattacchione said, “While the current environment remains challenging, with the acquisitions of both PRO-DIP LLC and Acenzia Inc., along with recently adding proven senior leadership to the Novo family team, we believe our financial condition is strong and we look ahead to the remainder of 2021 with optimism and dedication to growth.”

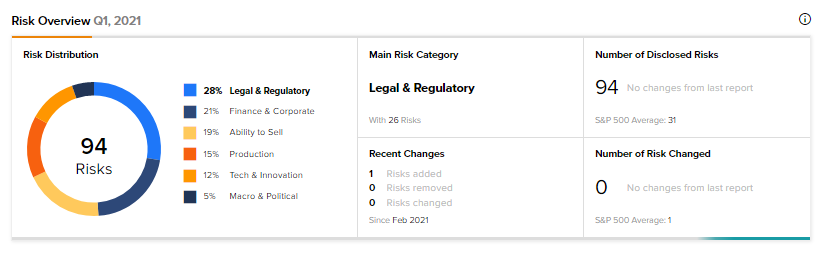

According to the new Tipranks Risk Factors tool, Novo’s main risk category is Legal & Regulatory, which accounts for 28% of the total 94 risks identified. The next two major risk factor contributors are Finance & Corporate and Ability to Sell at 21% and 19%, respectively. Since February, the company has added one new risk factor under Macro & Political category.

Novo acknowledges that public health epidemics or outbreaks could negatively impact its operations. So far, in fiscal 2021, NHL’s contracted eldercare associated services have seen a nominal impact. Novo expects this impact to continue for the rest of the fiscal as well.

Additionally, Novo admitted that all of its business segments, across all of its geographies, have been impacted to some extent but the full extent of the impact of COVID-19 on its business and its possible duration cannot be determined in the current scenario.

The Legal & Regulatory risk factor’s sector average is at 20%, compared to Novo’s 28%. Shares are down 46% so far this year.

Related News:

Eaton Reaches Two Milestones in Hydraulics Business Sale

PNC Financial’s Q2 Results Top Estimates

Ali Holding to Acquire Welbilt