Swiss-American pharmaceutical behemoth Novartis International AG (NYSE: NVS) has decided to cut 8,000 jobs to improve its bottom line, as part of a previously announced restructuring plan. Shares closed down 1.3% at $84.17 following the news yesterday.

Novartis will cut approximately 7.4% of its 108,000 workers globally. The cut would impact around 1,400 employees in Switzerland, out of the current 11,600 employees.

In April 2022, Novartis announced changes to its organizational structures, including merging its Oncology and Pharmaceutical businesses into one arm, Innovative Medicines (IM). This step, it said, would “increase focus, strengthen competitiveness and drive synergies.”

The company had expected to eliminate redundant jobs in single-digit thousands at the time which would lead to cost savings of at least $1 billion annually by 2024. The company is also finding a suitable buyer for its generic drug business Sandoz and expects to take a decision by the end of 2022.

For the full year fiscal 2022, Novartis expects sales from the IM segment to grow by mid-single digits over FY21 sales of $51.6 billion. Meanwhile, Sandoz is expected to report sales in line with last year’s figure of $9.6 billion. The company had also announced a share buyback plan of up to $15 billion in December 2021, of which the company has repurchased shares worth approximately $2.5 billion in Q1FY22.

Investors Weigh In

TipRanks’ Stock Investors tool shows that investor sentiment is currently Positive on Novartis, with 2.4% of portfolios tracked by TipRanks increasing their exposure to NVS stock over the past 30 days.

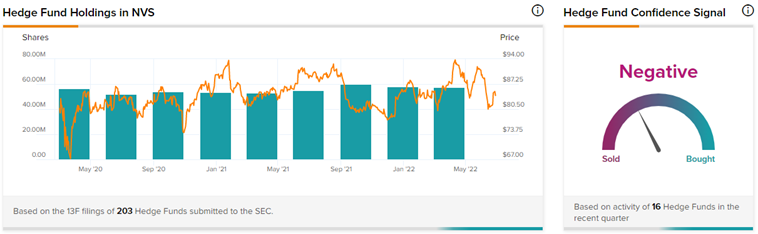

Meanwhile, TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Novartis is currently Negative, as 16 hedge funds decreased their cumulative holdings of NVS stock by 283,200 shares in the last quarter.

Parting Thoughts

Novartis is undertaking strategic plans to boost performance. Although in the short term, these steps may hurt, in the long term, these will prove to be beneficial to both the company and its shareholders.