Norwegian Cruise Line (NYSE:NCLH) shares are ticking higher today after the cruise company posted better-than-anticipated third-quarter numbers. EPS of $0.76 exceeded expectations by $0.07. Impressively, revenue soared by 56.8% year-over-year to $2.54 billion, outpacing expectations by $10 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, total revenue per passenger cruise day increased by 16% compared to 2019 levels, and occupancy remained at a healthy 106%. Notably, NCLH is witnessing robust bookings for the fourth quarter with elevated pricing.

For the Fiscal year 2023, NCLH expects an adjusted EBITDA of $1.86 billion. Amid the current global macroeconomic environment, NCLH is focusing on rightsizing its cost base. Despite improving demand, the company has lowered its adjusted EPS expectations for the year to $0.73 from the prior outlook of $0.80. Occupancy for the year is anticipated to average 102.6%.

Is NCLH Stock a Good Buy?

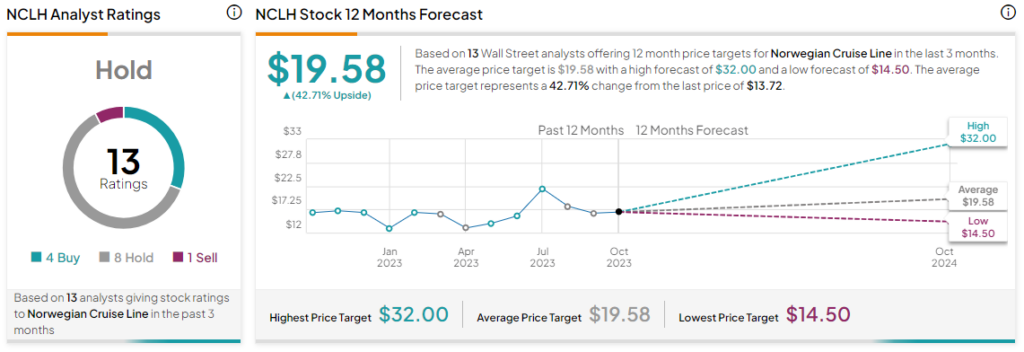

Overall, the Street has a Hold consensus rating on Norwegian Cruise Line. The average NCLH price target of $19.58 implies a hefty 42.2% potential upside. That’s after a nearly 18% slide in the share price over the past month.

Read full Disclosure