Fashion merchandise retailer Nordstrom, Inc. (NYSE:JWN) is protecting itself and its shareholders from the possibility of a hostile takeover by adopting a “poison pill.” The board of directors issued a shareholder rights plan on September 19 for the same.

As per the rights plan, each shareholder on record as of September 30 will receive a dividend in the form of a common stock right, for each share held by them. The rights have a one-year duration, expiring on September 19, 2023.

These shares will be exercisable if any group or individual tries to take more than a 10% stake in Nordstrom. At such a time, each shareholder will be entitled to purchase additional JWN shares at a 50% discount to the then-current market price, thereby diluting the stake of the potential acquirer. Meanwhile, the stake of the Nordstrom family, which owns about 30% of the merchandise retailer, will be grandfathered in.

Here’s What Triggered Nordstrom to Adopt the Poison Pill

In a regulatory filing dated September 15, Mexican retailer El Puerto de Liverpool SAB disclosed that it had purchased 15,755,000 shares of Nordstrom. The purchase made him the second largest shareholder of JWN, representing 9.9% of Nordstrom’s outstanding shares.

Liverpool’s stake disclosure led Nordstrom to adopt the shareholder rights plan to avoid the chances of any hostile takeover of the company. The Mexican retailer operates luxury department stores in Mexico and has acquired other smaller retailers on prior occasions.

Liverpool spent approximately $295 million (5.9 billion pesos) at current exchange rates, to buy JWN stock. The company stated that it acquired JWN stock to diversify geographically.

Meanwhile, Nordstrom’s board stated that “The Rights Plan has not been adopted in response to any specific takeover bid or other proposal to acquire control of the Company, and is not intended to deter offers that are fair and otherwise in the best interests of all Nordstrom shareholders.”

Is JWN Stock a Good Buy?

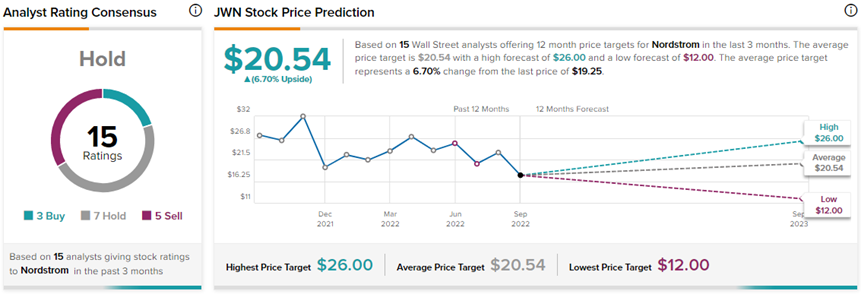

On TipRanks, JWN stock has a Hold consensus rating. This is based on three Buys, seven Holds, and five Sells. The average Nordstrom price forecast of $20.54 implies 6.7% upside potential to current levels. Meanwhile, the stock has lost 17.7% so far this year.

Nordstrom is having difficulty moving its inventory off the shelf. Accordingly, the retailer has lowered its fiscal 2022 revenue and earnings per share guidance. Overall, analysts are skeptical about the forward trajectory of the retail sector. Retailers worldwide are challenged with excess inventory issues, supply chain, and logistics problems, and waning consumer demand owing to record high inflation.