Nordstrom (JWN) announced that it needs to delay the filing of its annual report on stock purchases and savings plans as a result of “significant” disruptions tied to the coronavirus pandemic.

Shares fell 7.2% to $15.97 on Wednesday. The retailer expects to file the 11-K annual report no later than July 31, it said in a SEC filing.

In an update on its operations, Nordstrom said that currently about 90% of its 354 stores have reopened across the U.S. and Canada. In addition, the company said that it is on track to be fully operational by the end of June, although many stores are functioning at reduced hours in accordance with local restrictions.

“Our operations and business have experienced significant disruptions due to the unprecedented conditions surrounding the COVID-19 pandemic,” Nordstrom said. “As a result of these disruptions, key personnel devoted considerable time and resources to preparing and filing on time our Quarterly Report on Form 10-Q for the quarterly period ended May 2, 2020. Accordingly, our team has not been able to devote the requisite time and attention to the 11-K.”

Nordstrom shuttered all of its stores on March 17. Some started to reopen in early May and since then in a phased market-by-market approach more stores opened their doors. Due to the uncertainty of COVID-19, Nordstrom is continuing to assess the situation, including government-imposed restrictions, market by market, it said.

Since mid-March, the family-run retailer has implemented a number of cost-cutting measures including furloughs, reduction in overhead costs, inventory management, and liquidity management in a move to improve financial flexibility.

Nordstrom has been hit hard this year with the stock plunging 61%. Guggenheim analyst Robert Drbul notes that although Nordstrom has taken prudent actions to shore up liquidity and improve the overall cost structure and can benefit from its significant online penetration, he believes shares are fairly valued given the uncertainty in the U.S. retail environment.

“As such, we remain Neutral-rated until we see a return to normal operating procedures and the company demonstrates margin improvement,” Drbul wrote in a note to investors.

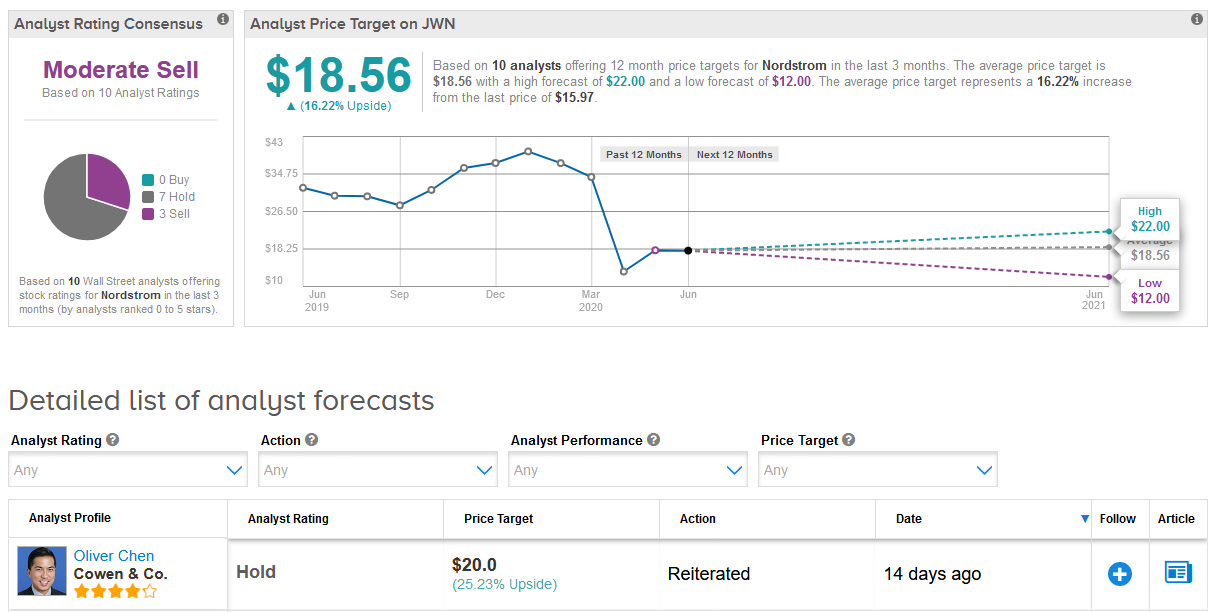

The Wall Street analyst community has a Moderate Sell consensus on Nordstrom stock with 7 Holds and 3 Sells. The $18.56 average price target reflects 16% upside potential over the next 12 months. (See Nordstrom stock analysis on TipRanks).

Related News:

Google and Carrefour Roll Out Voice-Based Shopping Service In France

Slack Seeks To Replace E-mail With Launch Of Virtual Business Platform

Apple Reveals Custom-Made Chips, Ending Intel Relationship