Back in 2017, an event took place that fundamentally shaped the computing landscape for most of the next 10 years to follow. OpenAI actually came looking for investment from chip stock Intel (INTC), and Intel showed OpenAI the door. Now, with OpenAI a massive new operation, it revealed that it will not be buying chips from Intel in the future. Investors took the news mostly in stride, sending Intel down fractionally in Wednesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

So not only did Intel lose its AI head, Sachin Katti, to OpenAI, but it also lost any hope of a chip order from the surging artificial intelligence (AI) giant. As for why, OpenAI did not say specifically, but a quote from Carnegie Mellon’s Tepper School of Business associate professor Tim Derdenger spelled out what Intel is facing with OpenAI. Derdenger noted, “Why go back to a firm that has an inferior product and also snubbed you?”

Given that OpenAI has been actively looking for chip makers to help it break the Nvidia (NVDA) stranglehold on the market, but appears to be just as actively refusing Intel, the situation has to be galling for Intel. There is still some hope; Circular Technology’s global head of research Brad Gastwirth called it “…possible but still unlikely near-term.” But Intel will still have to face performance issues to really get OpenAI on its side.

New Director

Intel also recently augmented its board of directors, bringing in Craig Barratt to serve as an independent director. Barratt was brought on in short order, and has already begun his tenure. Intel will not be the only board on which he serves, either. Reports note he currently serves on Intuitive Surgical’s (ISIG) board, as well as Astera Labs, Ayar Labs, Atmosic Technologies, and the Stanford University Center for Digital Health.

Barratt has over three decades’ worth of experience in the semiconductor market, which should make him especially helpful to Intel. He has actually been employed with Intel since 2019, serving as senior vice president and general manager after Intel bought Barefoot Networks. Barratt was actually CEO at the time.

Is Intel a Buy, Hold or Sell?

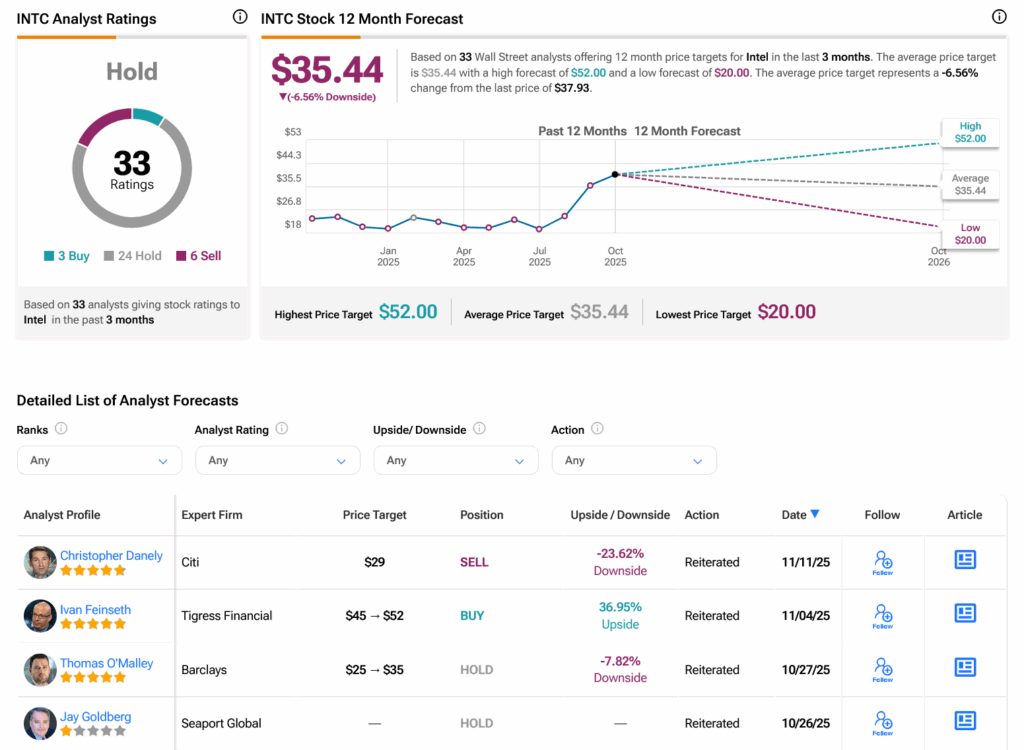

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on three Buys, 24 Holds and six Sells assigned in the past three months, as indicated by the graphic below. After a 52.01% rally in its share price over the past year, the average INTC price target of $35.44 per share implies 6.56% downside risk.