According to a Reuters report, NIO (NYSE:NIO), the Chinese EV maker, is planning to spin off its battery manufacturing unit in order to be profitable, lower costs, and improve efficiency. The battery unit will seek external investors after the spin-off, which could happen at the end of this year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While NIO declined to comment on the news, the company’s founder and CEO, William Li, had commented during the third-quarter earnings call that NIO is planning to outsource the manufacturing of its batteries. However, it will continue to do in-house research and development on them. NIO currently buys all of its batteries from CATL and CALB group.

The company announced its Q3 results yesterday and reported narrower-than-expected losses.

What is the Price Target for NIO?

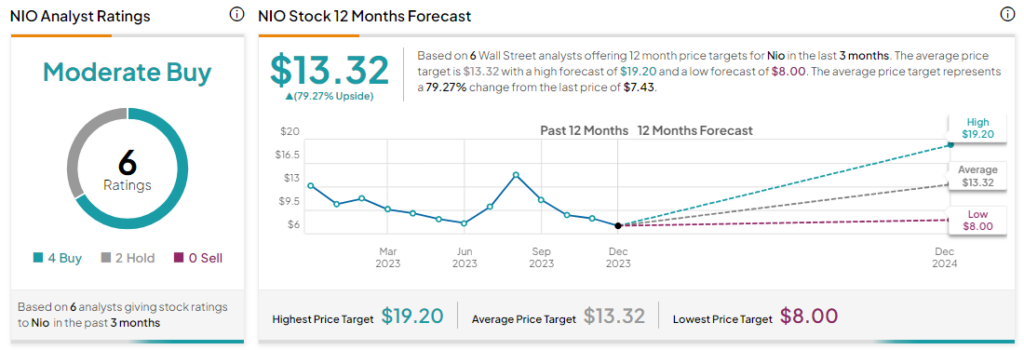

Analysts remain cautiously optimistic about NIO stock with a Moderate Buy consensus rating based on four Buys and two Holds. NIO stock has slid by more than 20% year-to-date, and the average NIO price target of $13.32 implies an upside potential of 79.3% at current levels.