Chinese multinational automobile manufacturer NIO Inc. (NYSE: NIO) has entered into a strategic partnership with steel producer Baoshan Iron & Steel (Baosteel) to collaborate in areas including products and supply chain, as per a report by CnEVPost. Shares of NIO rose 2.4% in the pre-market trading session on Wednesday.

Baosteel is a Shanghai-based company that manufactures and sells steel products. Its products include cold-rolled carbon steel coils, hot-rolled carbon steel coils, and steel pipe products.

The deal was announced in a signing ceremony held at Nio’s global headquarters in Shanghai’s Jiading district. The ceremony was attended by the Chairman of Baosteel, Zou Jixin, and Nio’s Founder, Chairman and CEO William Li.

Jixin said that Baosteel had an advantage in non-oriented silicon steel and automotive plates, while QCDDS is a core competency of its integrated material solutions. He added that the two companies would strengthen cooperation in green, low-carbon areas.

Li said, “NIO needs a global partner like Baosteel to work hand-in-hand on products, supply chain, technology innovation, new material applications and zero-carbon pathways.”

Wall Street’s Take

Recently, BofA Securities analyst Ming Hsun Lee reiterated a Buy rating on Nio with a price target of $65 (116.5% upside potential).

Lee said, “Management expects orders to continue to increase, driven by new model like ET7/ET5 and fast sales network expansion. Regarding the NEV subsidy cut in 2022, management stated that NIO’s average price came in at RMB420k, and the subsidy cut of RMB6-8k should have a limited impact.”

Consensus among analysts is a Strong Buy based on 7 Buys and 1 Hold. The Nio stock price prediction stands at $63.14 and implies upside potential of 110.3% to current levels.

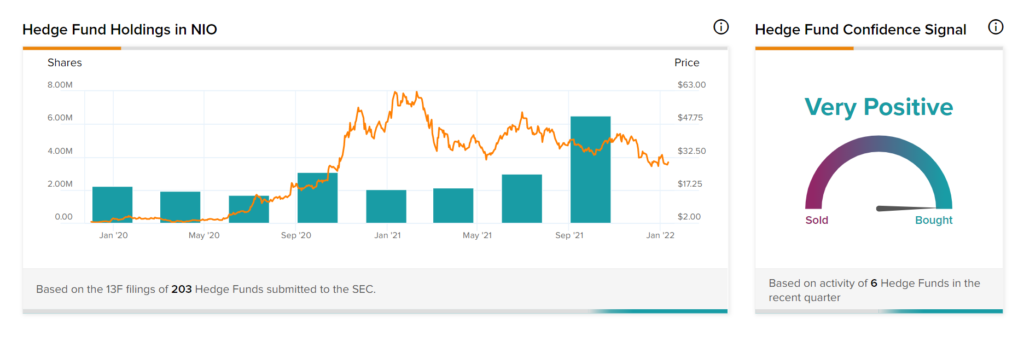

Decreased Hedge Fund Trading

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Nio is currently Very Positive, as the cumulative change in holdings across all 6 hedge funds that were active in the last quarter was an increase of 3.5 million shares.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

ExxonMobil Acquires 49.9% Interest in Biojet

Illumina Discloses Preliminary Results, 2022 Outlook & Announces Partnerships

Rio Tinto to Buy Electric Trains from Wabtec to Lower Carbon Emissions