Shares of Nike (NYSE:NKE) declined about 12% in yesterday’s extended trading session after the company reported mixed fiscal second-quarter results and revised its sales outlook lower. Alongside earnings, NKE unveiled plans to cut costs by $2 billion over the next three years owing to the sluggish consumer demand trend, especially in China and Europe.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nike designs and manufactures athletic footwear, apparel, accessories, and equipment.

Updated Outlook

At its Q2 earnings call, the management said that the company is witnessing slow traffic on its digital platforms and stiff competition from its rivals. Moreover, Nike cited “increased macro headwinds” in Greater China and Europe, the Middle East, and Africa as a key reason for the lowered sales forecast.

For Fiscal 2024, Nike anticipates that revenue will grow by about 1%, compared with the prior outlook of mid-single-digit growth.

NKE’s $2B “Save-to-Invest” Program

The company aims to lower costs by simplifying its product range and focusing on new products based on the latest consumer preferences. Also, Nike seeks to drive efficiency by leveraging its scale and improving supply chains. Furthermore, the cost-cutting measures include reductions in management layers and organizational restructuring, impacting some employee positions.

It is worth mentioning that NKE will be investing these savings in its women’s and running divisions and the Jordan brand to support future growth. In addition to this, the company will allocate funds towards increasing the adoption of automation and technology throughout its operations.

Due to its cost-savings plan, NKE expects to incur an expected pre-tax charge of between $400 million and $450 million in the fiscal third quarter, largely due to severance costs.

Is Nike Stock a Buy, Sell, or Hold?

The company’s plans to increase automation and streamline operations are encouraging. Additionally, the shift in focus to introduce new products as per changing preferences would help Nike meet growing competition in the footwear industry.

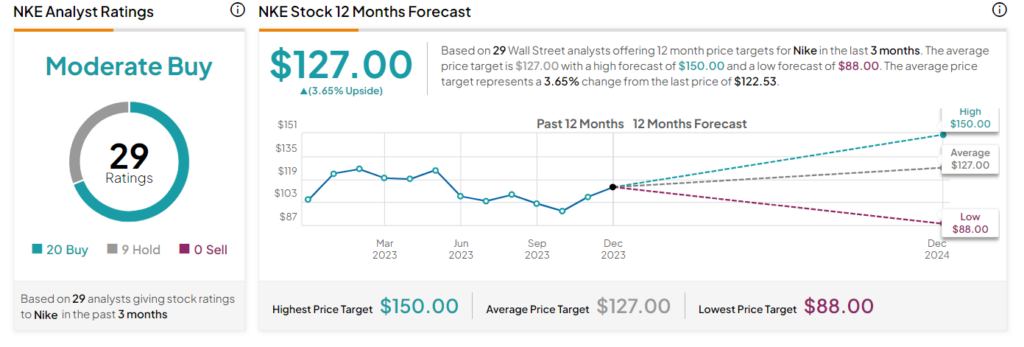

Wall Street analysts are currently cautiously optimistic about Nike stock. It has a Moderate Buy consensus rating based on 20 Buys and nine Holds. The average NKE stock price target of $127 implies a 3.4% upside potential. Shares of the company have gained 6.1% so far in 2023.