Holiday sales growth brought some relief to retail investors following the 1.1% decline in November sales reported by the US Department of Commerce recently.

As per Mastercard SpendingPulse, retail sales in the Nov. 1-Dec. 24 holiday period (excluding automotive and gasoline sales) grew 2.4%. Preliminary data reflects a 47.2% rise in online sales during the holiday period, reflecting the shift in consumer shopping preference from physical stores to digital channels.

While the home improvement, as well as home furniture and furnishings categories, posted double digit-growth, sales of apparel and department stores were weak in the crucial shopping season for the retail sector.

Amid an uncertain business environment, there are some companies which are recovering well and are expected to emerge stronger on the other side of the pandemic. We will use TipRanks’ Stock Comparison tool to stack up Nike against Under Armour and select the retail stock offering the better investment opportunity in the current climate.

Nike (NKE)

Footwear and apparel giant Nike has recovered rapidly after experiencing a significant sales slump due to the temporary closure of stores. Recently, the company reported better-than-anticipated 2Q FY21 (ended Nov. 30) results and returned to revenue growth after reporting a decline in the top line for two straight quarters. Notably, revenue rose 9% year-over-year to $11.2 billion and EPS grew 11% to $0.78 in 2Q.

Key growth drivers for 2Q performance included an 84% spike in digital sales and a 24% rise in revenue from Greater China. Also, robust digital sales helped the company’s North America segment recover with a 1% revenue growth. (See NKE stock analysis on TipRanks)

Nike has been focusing on its direct-to-consumer business, including digital channels, even before the pandemic. The current health crisis has fueled Nike’s e-commerce growth and has helped the company exceed its digital penetration goal of 30% (across owned and partnered channels) almost three years earlier than planned.

The company is also enhancing its offerings and driving innovation based on consumer needs. For instance, it is now offering over 100 styles of extended sized apparel across Nike and Jordan brands for women and aims to further expand its merchandise in this category.

Looking ahead, Nike expects low teens revenue growth in FY21, driven by continued focus on digital channels even as its wholesale business and company-owned stores remain under pressure due to the pandemic. The growing interest in fitness is expected to boost the company’s athletic apparel and footwear sales supported by continued innovation.

Covering Nike for Guggenheim, analyst Robert Drbul stated in a research note to investors, “Under the leadership of CEO John Donahoe, Nike is rapidly embarking on the next era of its company history; this will be digitally-led and likely defined by even greater separation vs. industry peers as well as from Nike’s own historical rates of productivity, consumer engagement, and financial performance.”

In reaction to the recent results, Drbul said that Nike remains his “Best Idea” and reiterated a Buy rating with a price target of $165. He believes that the Nike brand commands a dominant market share, which he expects will grow significantly as “digital scales further, new product innovation remains robust, and heavy investment behind key growth drivers continues, while some global peers operate more cost-consciously in an uncertain environment.”

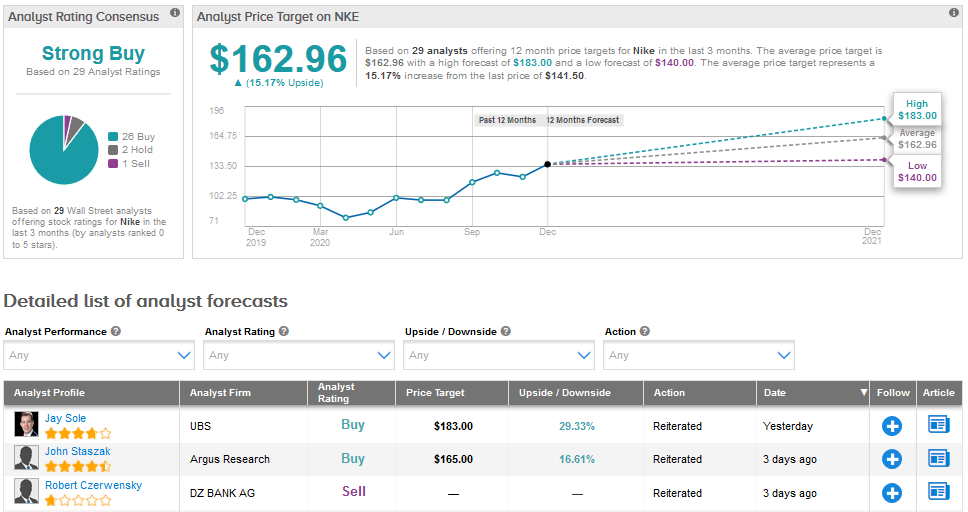

The rest of the Street also has a bullish outlook on Nike. Overall, 26 Buys versus 2 Holds and 1 Sell add up to a Strong Buy analyst consensus. The average price target of $162.96 indicates upside potential of 15.2% over the coming year. Nike shares have advanced 39.7% year-to-date.

Under Armour (UAA)

Under Armour has been trying to turnaround its business amid several challenges, including heightened competition from rivals like Nike and Adidas due to a lack of innovation and the SEC’s investigation into the company’s accounting practices.

The company is now trying to regain its premium brand positioning, which got diluted due to heavy exposure to wholesale channels like off-price retailers, department stores and independent retailers. Under Armour is reducing its exposure to the off-price channel and other undifferentiated distribution points. It is also cutting down promotions and discounts in its direct-to-consumer business.

Under Armour’s 3Q revenue grew marginally to $1.43 billion in 3Q while adjusted EPS increased 13% to $0.26. However, due to the impact of the pandemic, the company expects full-year revenue to fall at a high-teen percentage rate. (See UAA stock analysis on TipRanks)

Even after Under Armour’s better-than-feared 3Q performance, Needham analyst Rick Patel maintained his Hold rating on the stock due to “low visibility on the company’s turnaround while Covid-19 creates another layer of uncertainty.”

“UAA has made progress in right-sizing its inventory and improving product, but it’s not yet clear if UAA can deliver higher sales in N. America after Covid-19 headwinds ease. We anticipate stronger growth abroad, in line with the company’s plan, as UAA benefits from new distribution,” added Patel

Over the long-term, Patel expects Under Armour’s gross margin to expand, partly led by favorable sales mix changes due to direct-to-consumer and international outperformance and also anticipates continued focus on expense control. He sees progress being made, but “not enough to see significant upside to estimates,” thus keeping him on the sidelines.

Meanwhile, Wells Fargo analyst Tom Nikic upgraded Under Armour to Buy from Hold last month and increased the price target to $23 from $15. In a research note to investors, Nikic stated, “In recent years, we’ve seen several big turnarounds by athletic brands (LULU, Adidas, etc.), and we think UAA is poised to be the next. After years of struggles, we believe that the brand is finally starting to turn (as evidenced by the first positive DTC comp in over 3 years in 3Q), and we believe investors will look toward this stock given its lagged athletic peers significantly YTD.”

Overall, the Street is sidelined on Under Armour, with a Hold analyst consensus based on 6 Buys, 14 Holds and 1 Sell. Shares have already declined 19.4% year-to-date and the average price target of $15.95 reflects further downside potential of 8.4% from current levels.

Conclusion

Nike’s brand, strong operational performance, innovation and extensive market reach give it an edge over Under Armour. Aside from the competitive advantage, the upside potential in the stock makes Nike a better pick than Under Armour.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment