NextEra Energy (NEE) has announced a four-for-one split of its common stock, which it says should make stock ownership more accessible to a broader base of investors.

Each shareholder of record on Oct. 19, 2020, will receive three additional shares of common stock for each share, to be distributed on Oct. 26, 2020. Trading will begin on a stock split-adjusted basis on Oct. 27, 2020.

NEE also boosted its financial expectations, citing the ongoing strength of the renewables development environment and the continued execution across its businesses.

For 2022 and 2023, NextEra Energy now expects to grow 6% to 8%, off the expected increased 2021 adjusted earnings per share. For 2022 and 2023, this translates to a range of $2.55 to $2.75 and $2.77 to $2.97, respectively.

For 2021, NextEra Energy is increasing its financial expectations ranges by $0.20 and now expects adjusted earnings per share to be in the range of $9.60 to $10.15. For 2022 and 2023, NextEra Energy expects to grow 6% to 8%, off the expected increased 2021 adjusted earnings per share.

“The market for low-cost renewables continues to rapidly expand, and we believe our best-in-class development skills leave us uniquely positioned to capitalize on these significant investment opportunities… I will be disappointed if we are not able to deliver financial results at or near the top end of our adjusted earnings per share expectations ranges in 2020, 2021, 2022, and now 2023 ” said Jim Robo, NextEra Energy CEO.

Shares in NEE rose 6.45% in Monday’s after-hours trading, with shares already trading 16.4% higher on a year-to-date basis. (See NextEra stock analysis on TipRanks)

“A 20-cent increase to 2021 guidance and an extension of the 6-8% growth rate through 2023 off the increased base further highlight NEE’s position as a leader in the space” cheered RBC Capital’s Shelby Tucker on the news.

“We think the increased guidance serves as another data point on the accelerating growth in renewables and NEE’s ability to successfully capitalize on its entrenched status” he stated.

Tucker reiterated his buy rating and $297 price target, adding that behavioral finance suggests that the increased “accessibility” of the four-for-one stock split might also be a draw for retail investors.

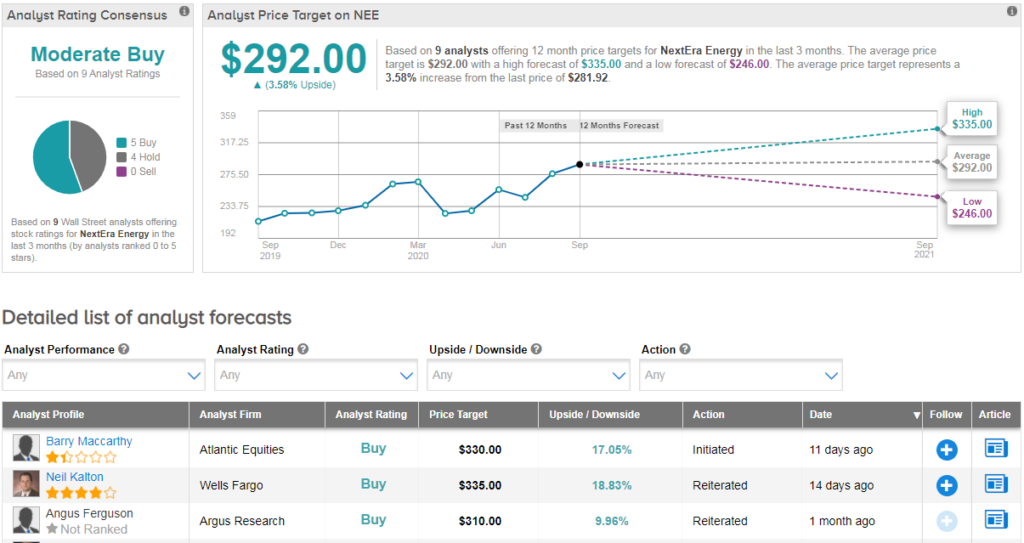

Overall analysts have a cautiously optimistic outlook on the stock, with 5 recent buy ratings and 4 holds adding up to a Moderate Buy consensus. Meanwhile the average analyst price target of $292 indicates 4% upside potential lies ahead.

Related News:

Energy Transfer To Reroute Mariner Pipeline After Major Fluid Spill

BP Joins Up With Equinor For $1.1B Offshore Wind Partnership

Tesla Hatches Plan To Secure Low Carbon Nickel- Report