Technology giant Alphabet’s (GOOGL) cash-rich advertising business is at the risk of being broken up due to the huge monopolistic advantage of being a key player at every link in the chain, a Wall Street Journal report stated.

Shares sank about 1.7% on the news and ended the day down 1.4% at $2,207.68 on May 19.

What Gives Google a Competitive Edge in the Ad Business?

Notably, Google has a presence in every link of the advertising business, right from buying and selling advertisements to auction houses and exchanges that implement transactions in split seconds.

Google’s advertising business generates revenue through Google search properties and other Google-owned and operated properties like Gmail, Google Maps, and Google Play; YouTube ads generated on YouTube properties; and revenues generated from Google Network properties participating in AdMob, AdSense, and Google Ad Manager.

In its Q1FY22 results, Google reported advertising revenues worth $44.68 billion, growing 32.3% year-over-year.

The Competition and Transparency in Digital Advertising Act

The Republican Party has introduced The Competition and Transparency in Digital Advertising Act, which seeks to minimize the monopolistic benefit in the advertising technology industry. The bill has also won the support of a few Democratic senators.

Utah Republican Mike Lee, in support with Sens. Ted Cruz (R., Texas), Amy Klobuchar (D., Minn.), and Richard Blumenthal (D., Conn.), has co-sponsored the bill seeking to reduce the influence and bargaining power of technology bigwigs.

As per the bill, companies with advertising revenue of over $20 billion in digital transactions annually will be withheld from engaging in more than one link in the digital advertising ecosystem.

Google is one of the largest American advertising companies that comes directly under the radar of the bill and will be forced to break up its advertising business. After its acquisition of DoubleClick Inc. in 2008, Google saw its advertising business flourish in leaps and bounds.

The legislation also affects Meta Platforms’ (FB) Facebook business, which earns advertising revenues.

Once the bill becomes law, companies including Alphabet and Meta Platforms will have a year to comply with the new rules. This would also mean that customers would be able to sue advertising companies that violate the law or fail to be transparent in their processes.

Official Comments

Lee said, “When you have Google simultaneously serving as a seller and a buyer and running an exchange, that gives them an unfair, undue advantage in the marketplace, one that doesn’t necessarily reflect the value they are providing… When a company can wear all these hats simultaneously, it can engage in conduct that harms everyone.”

In response to the bill, a Google spokeswoman said, “Advertising tools from Google and many competitors help American websites and apps fund their content, help businesses grow, and help protect users from privacy risks and misleading ads.”

“Breaking those tools would hurt publishers and advertisers, lower ad quality, and create new privacy risks. And at a time of heightened inflation, it would handicap small businesses looking for easy and effective ways to grow online. The real issue is low-quality data brokers who threaten Americans’ privacy and flood them with spammy ads,” she concluded.

Stock Prediction

Based on 30 unanimous Buys, GOOGL stock commands a Strong Buy consensus rating. The average Alphabet price forecast of $3,262.55 implies 47.8% upside potential to current levels. Meanwhile, Alphabet shares have lost 23.9% year-to-date.

Risk Analysis

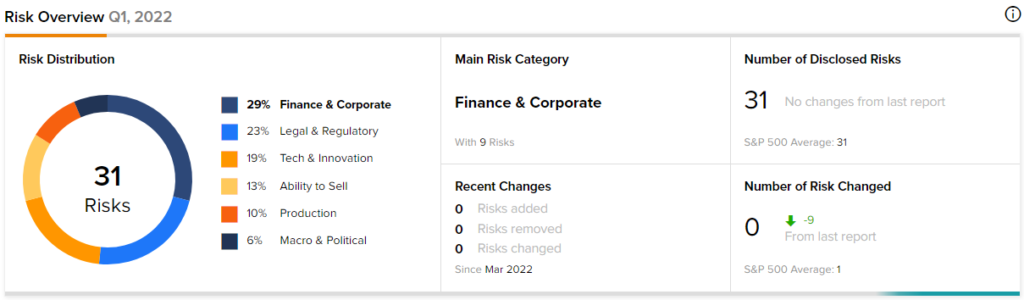

Due to its very nature of business, Alphabet is constantly at risk of litigation and complaints. According to the TipRanks Risk Factors tool, Alphabet stock is at risk mainly from two factors: Finance & Corporate and Legal & Regulatory, which contribute 29% and 23%, respectively, to the total 31 risks identified for the stock.

Conclusion

Alphabet has regularly listed legal matters related to antitrust investigations, intellectual property claims, and other matters such as claims, suits, regulatory and government investigations, and other proceedings involving competition as being a constant threat to its business operations. This bill presents one such claim that may vastly deter its business performance if passed.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Spirit Airlines Fights JetBlue Over Acquisition by ULCC

KoGuan Leo’s Tweet Urges Musk for TSLA Stock Buyback

Cathie Wood Tweet Raises Concern as Big Retailers Deal with Excessive Inventories