Despite having increased the prices of its products to offset rising cost pressure, Nestle SA (NSRGY) has reported robust growth in sales for the first three months of 2022. The company said that it has noticed “sustained consumer demand.”

Organic growth came in at 7.6% due to higher sales in all the product categories, especially Purina PetCare. Nestle said that it achieved a 2.4% rise in volume against the price increase of 5.2%.

The figures come as a boon amid the current inflationary environment when people are likely to cut down on expenses to meet costs for necessities. The U.K.-Russia war has skyrocketed prices for essentials such as grains, cooking oil, gas and other commodities, forcing people to defer luxury costs.

At the same time, companies are forced to increase the prices of products to remain afloat. Despite elevated pricing, Nestle has witnessed sales growth on the back of its brand image, quality products and essential product range.

The CEO of Nestle, Mark Schneider, said, “Cost inflation continues to increase sharply, which will require further pricing and mitigating actions over the course of the year. The Nestlé team addressed these headwinds and advanced our long-term strategy and sustainability objectives with agility and determination. We confirm our guidance for the year.”

Outlook

For full-year 2022, the company projects organic sales growth of 5% and trading operating profit margin in the range of 17% to 17.5%. EPS in constant currency and capital efficiency are also expected to rise.

Dividend History

NSRGY has been consistently paying dividends annually since 2009. At present, it has an impressive payout ratio of 52.9%. On April 11, 2022, it announced a dividend of $2.56 per share.

Trading Activity

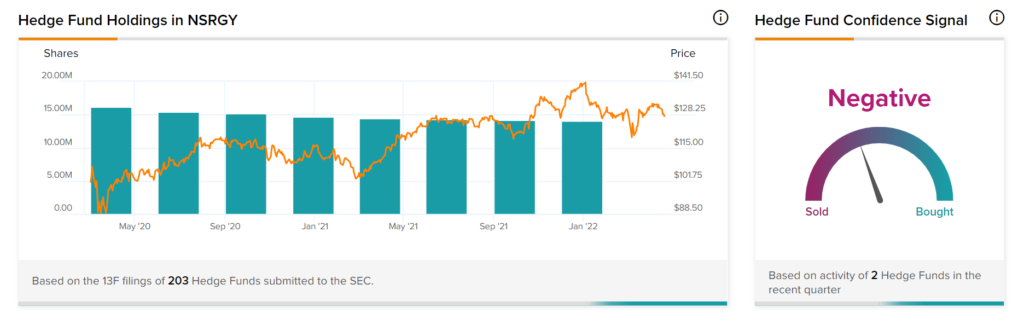

TipRanks’ Hedge Fund Trading Activity tool shows that confidence of hedge funds in Nestle is currently Negative, as the cumulative change in holdings across two hedge funds that were active in the last quarter was a decrease of 108,100 shares.

Takeaway

Rising prices of essentials, along with the company’s plans to further increase prices, may push consumers to search for cheaper alternatives. Also, hedge funds do not seem to be in Nestle’s favor. In NSRGY’s case, a wait-and-watch strategy is expected to be beneficial.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Abbott Rises on Q1 Earnings Beat

Snap Survives Q1 Miss Through Encouraging Q2 DAU Forecast

Why Did AT&T Gain Over 4% Despite Low Q1 Profit?