Shares of Nasdaq (NDAQ) were down in pre-market trading at the time of writing on Monday after the financial services company announced the acquisition of risk management and regulatory software firm, Adenza from Thoma Bravo, in a cash and stock deal worth $10.5 billion.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Nasdaq’s press release stated that Adenza has an “attractive financial profile” and is expected to generate $590 million of revenues this year and is likely to have an adjusted EBITDA margin of 58%. The company has a loyal client base that is growing with “98% gross retention, 115% net retention, and a durable mix of approximately 80% recurring revenue.”

Adenza is expected to grow Nasdaq’s Solutions Businesses revenues to 77% by the end of this year as compared to a growth of 71% today, increase its adjusted EBITDA margin to 57%, and is expected to add around $300 million of annual unlevered pre-tax cash flow.

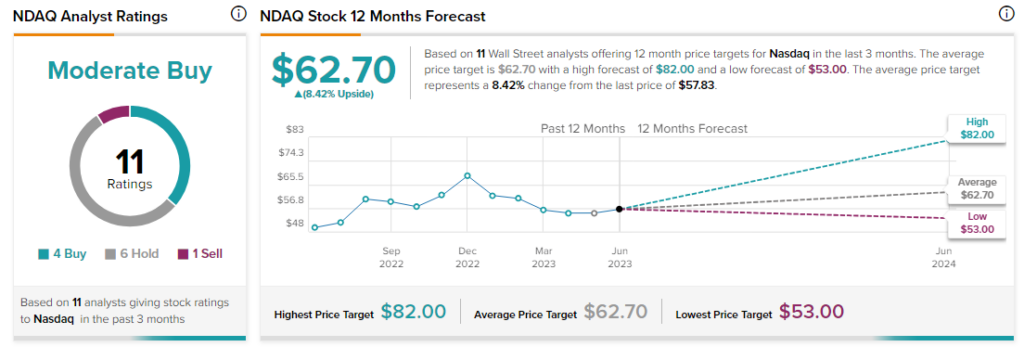

Analysts are cautiously optimistic about NDAQ stock with a Moderate Buy consensus rating based on four Buys, six Holds, and one Sell.

,