NAPCO Security Technologies, Inc. (NSSC) shares jumped almost 16% on Monday to close at $44.06 after the company delivered blowout fiscal fourth-quarter results topping estimates. Results were driven by continued momentum and strong recurring revenue margins.

Notably, the company reported its highest-ever sales and profits for the fourth quarter despite global logistic and supply chain constraints. The beat was mainly driven by strong momentum in its fire alarm business, which was not impacted by the COVID-19 pandemic.

Markedly, shares of the company that makes high-tech electronic security products have gained 95% over the past year. (See Napco Security Technologies stock charts on TipRanks)

Earnings of $0.27 per share grew significantly year-over-year in Q4 and beat analysts’ expectations of $0.25 per share. The company reported a loss of $0.10 per share in the prior-year period.

Net sales jumped 54% year-over-year to $35.4 million and exceeded consensus estimates of $29.8 million. The increase in revenues reflected a 43% surge in recurring service revenue, which increased to $9.5 million.

On top of this, the overall gross margin jumped 800 bps to 43%, driven by robust gross margin growth in recurring service revenue, which jumped 400 bps year-over-year to 87%.

Together with the earnings release, NAPCO’s Chairman Richard Soloway shared his views on the introduction of the new cellular, cloud-hosted access control product line, Air Access, saying, “While still in the very early stages, we expect this product line to provide the Company the opportunity to generate recurring service revenue from each of our divisions: alarms & connectivity, locking and access control.”

He further added, “We remain focused on generating strong revenue growth as well as increased profitability. As we look to fiscal 2022 and beyond, NAPCO is well positioned for long-term growth and profitability expansion.”

The stock has picked up a rating from one analyst in the past three months. William Blair analyst Matthew Pfau reiterated a Buy rating on the stock following the upbeat Q4 earnings results.

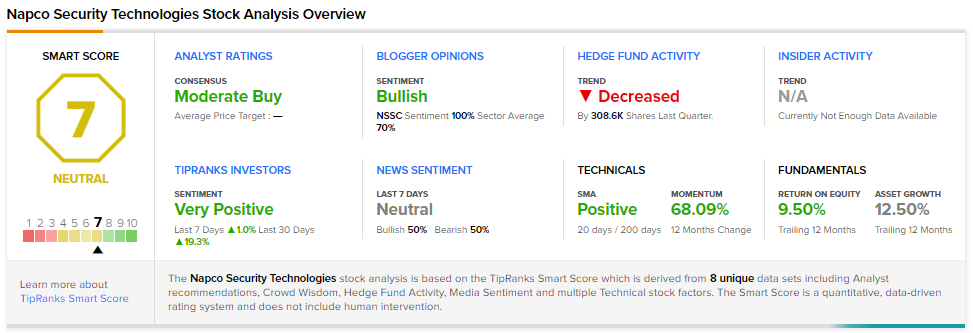

NSSC scores a 7 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock is likely to perform in line with market expectations.

Related News:

U.S. Judge Rules That Apple Must Allow Developers Other Payment Options – Report

Virgin Galactic Reports Delay in Unity 23 Test Flight, Shares Fall 3.8% in Pre-Market

Stanley Black & Decker to Snap Up Excel Industries for $375M