Banking giant Morgan Stanley (NYSE:MS) fell in pre-market trading as the bank’s Q3 investment banking revenues slid 27% year-over-year to $938 million. The bank reported third-quarter earnings of $1.38 per share as compared to $1.47 in the same period last year but above consensus estimates of $1.31 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Net revenues in Q3 increased by 2.2% year-over-year to $13.3 billion versus Street estimates of $13.2 billion.

The bank’s Fixed Income business segment generated revenues of $1.95 billion in revenue, while equity traders made $2.51 billion in revenue. Morgan Stanley’s all-important Wealth Management business posted revenues of $6.4 billion in the third quarter.

Is Morgan Stanley a Good Stock to Buy Now?

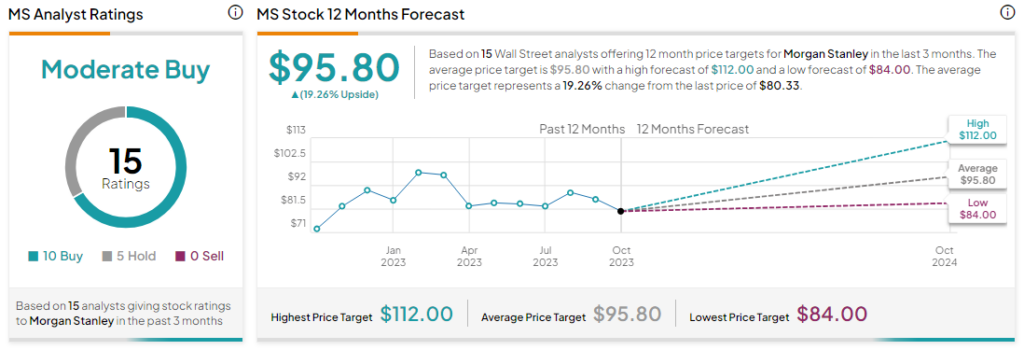

Analysts are cautiously optimistic about MS stock with a Moderate Buy consensus rating based on 10 Buys and five Holds. The average MS stock price target is $95.80, implying an upside potential of 19.3% at current levels.