Moderna announced on Friday that the U.S. Food and Drug Administration (FDA) has approved the emergency use of its COVID-19 vaccine mRNA-1273 in patients aged 18 years and older. Shares gained 2.2% in after-hours trading.

Following the approval, Moderna (MRNA) now plans to deliver about 20 million doses to the U.S. government by the end of Dec. 2020. To date, the U.S. government has ordered 200 million doses from the biotechnology company and has retained the option to purchase up to an additional 300 million doses.

The company also seeks to submit a Biologics License Application (BLA) for mRNA-1273 to the FDA for full U.S. licensure in 2021.

Earlier that day, Moderna announced that the European Commission had exercised its option to purchase an additional 80 million doses of the COVID-19 vaccine, taking the total order tally to 160 million doses.

“It has been a 10-year scientific, entrepreneurial and medical journey and I am thankful to all those who have helped us get here. We remain focused on scaling up manufacturing to help us protect as many people as we can from this terrible disease,” said Moderna’s CEO Stéphane Bancel.

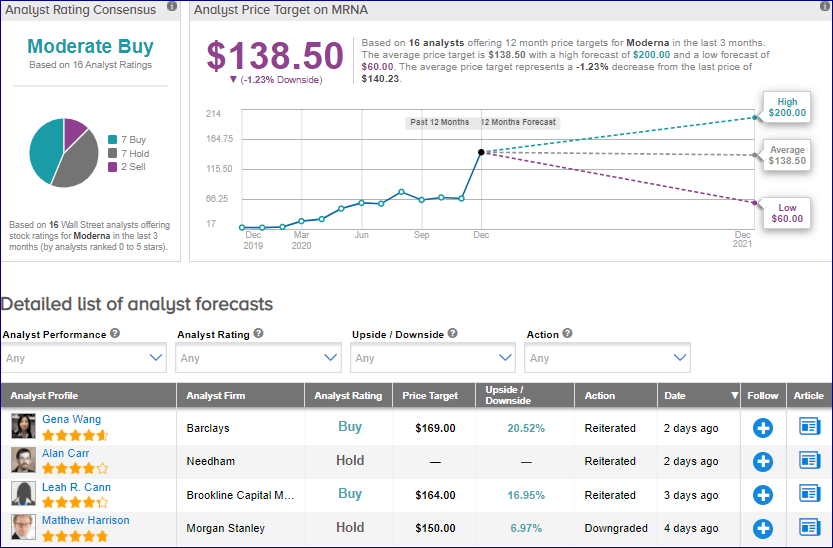

The stock price has surged 617% year-to-date and is trading at a discount of 21.4% to its 52-week high. (See MRNA stock analysis on TipRanks)

On Dec. 18, Barclays analyst Gena Wang doubled the stock’s price target from $84 to $169 and reiterated a Buy rating.

Wang’s recommendation was backed by the FDA advisory committee’s vote in favor of emergency-use authorization for the company’s COVID-19 vaccine.

The new price target, which implies an upside potential of 21%, reflects the likely approval of Moderna’s COVID-19 vaccine, healthier gross margin, and “validation” for a wider market opportunity, the analyst wrote in a note to investors.

From the rest of the Street, the stock scores a cautiously optimistic consensus of a Moderate Buy based on 7 Buys, 7 Holds, and 2 Sells. The average price target of $138.50 implies downside potential of 1.2% to current levels.

Related News:

Spotify to Launch in South Korea in 2021; Street is Cautiously Optimistic

FedEx Shares Fall 4% Despite 2Q Earnings Beat; Analysts Stay Bullish

GoGold Resources Reports Q4 Earnings Growth of 51%; Shares Up 2.2%