Vaccine maker Moderna, Inc. (NASDAQ: MRNA) posted better-than-expected second-quarter results backed by strong vaccine sales. The biotech company boasts advance purchase agreements (APAs) of around $21 billion in sales with expected delivery in 2022.

Remarkably, the Board approved a new $3 billion share buyback program in addition to the $1 billion remaining from the previous program. MRNA stock is up nearly 5% in pre-market trading at the time of writing.

Impressed with the results, Stéphane Bancel, CEO of Moderna said, “Despite the slowing economy and challenges in the biotech industry, Moderna is in a unique position: a platform to drive scale and speed in research of new medicines… Right now, we have four infectious disease vaccines in Phase 3 trials, and later this year, we expect important data from proof-of-concept studies in rare diseases and immuno-oncology. This is an exciting time for Moderna as we continue to see significant scientific and business momentum.”

Moderna’s Solid Q2 Results Impress

Moderna’s Q2 diluted earnings of $5.24 per share came in a whopping 75 cents higher than the consensus figure. However, the figure came in lower than Q2FY21 diluted earnings of $6.46 per share.

Furthermore, quarterly revenue of $4.75 billion rose 9.2% year-over-year and outpaced analyst estimates by $800 million. Product sales contributed $4.5 billion, growing 8% compared to the same period last year.

Looking ahead, of the $21 billion in APAs, Moderna expects sales in the fourth quarter to be higher than in the third quarter, driven by the timing of approval of updated COVID-19 vaccines and the manufacturing ramp-up of new products.

Analysts Are Cautious about Moderna

The Wall Street community is cautiously optimistic about MRNA stock with a Moderate Buy consensus rating based on five Buys, six Holds, and one Sell. The average Moderna price target of $216.55 implies 34.7% upside potential to current levels. Meanwhile, the stock has lost 31.6% so far this year.

Hedge Funds are Optimistic on MRNA

Interestingly, TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Moderna is currently Very Positive, as 16 hedge funds increased their cumulative holdings of MRNA stock by 2.9 million shares in the last quarter.

Bloggers are Bullish on MRNA

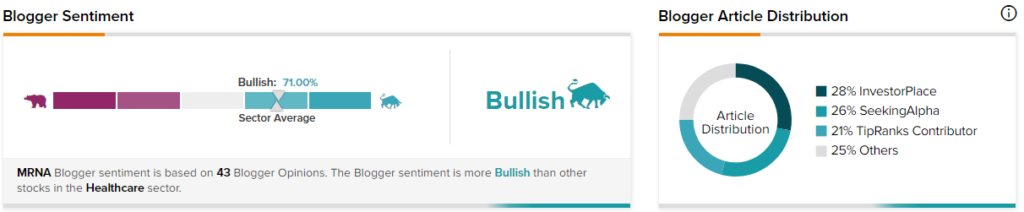

Notably, TipRanks data shows that financial blogger opinions are 71% Bullish on MRNA, compared to a sector average of 70%.

Ending Thoughts

Moderna is very well positioned for tremendous future growth for both its COVID-19 vaccines and other promising disease vaccines in the pipeline. Additionally, it continues to drive shareholder value by buying back stock. Moreover, hedge funds and bloggers have a solid belief in the vaccine maker’s progress, and analysts have a good upside target potential on the stock.