At the Society for Immunotherapy of Cancer’s (SITC) 36th annual meeting, Moderna (MRNA) has presented interim data from the ongoing Phase 1 clinical study of mRNA-2752 (Triplet) in patients with accessible solid tumors and lymphomas. This study is designed to evaluate the tolerability and safety of rising intratumoral injections of mRNA-2752 separately and also in combination with PD-L1 inhibitor (durvalumab).

The data demonstrated by the clinical-stage biotechnology company showed that the company’s mRNA Triplet program has a high tolerance level at all dose levels tested when given along with AstraZeneca’s (AZN) durvalumab (IMFINZI), and shown anti-tumor activity.

See Top Smart Score Stocks on TipRanks >>

Official Comments

The VP of Oncology Development at Moderna, Praveen Aanur, said, “We are encouraged by the interim data from our Triplet program, which combines three mRNAs into one therapy injected directly into the tumor…These interim results demonstrate the potential role of immune modulation on clinical outcomes and we look forward to full results from the dose expansion arm of the study.” (See Moderna stock charts on TipRanks)

Wall Street’s Take

Following the development, Piper Sandler analyst Edward Tenthoff reiterated a Buy rating and a price target of $348 (50.53% upside potential) on the stock.

Tenthoff believes that Moderna’s mRNA pipeline is going well but the COVID-19 vaccine “remains the primary near-term driver.”

Overall, the stock has a Hold consensus rating based on 6 Buys, 4 Holds and 3 Sells. The average Moderna price target of $310.27 implies 34.21% upside potential from current levels. Shares have gained 44.1% over the past six months.

Risk Analysis

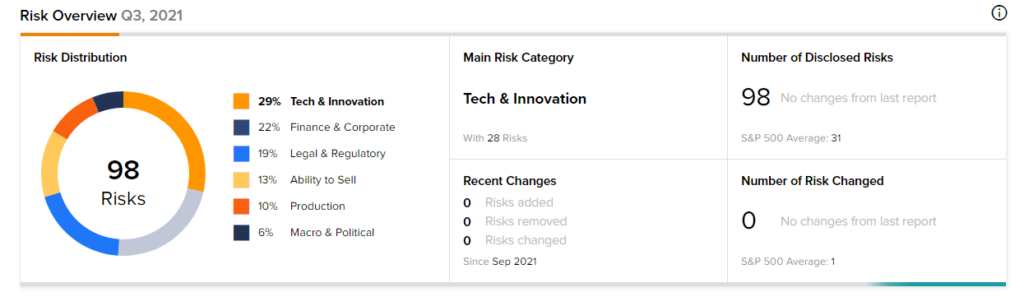

According to the new TipRanks’ Risk Factors tool, the Moderna stock is at risk mainly from three factors: Tech and Innovation, Finance and Corporate, and Legal and Regulatory, which contribute 29%, 22%, and 19%, respectively, to the total 98 risks identified for the stock.

Related News:

Blink Posts Record Q3 Revenues; Shares Gain After-Hours

Luminar Posts Quarterly Loss, Revenues Miss Estimates

Bright Health Tanks 32% on Wider-Than-Feared Quarterly Loss