Favorable updates on potential COVID-19 vaccines have been a major catalyst for stock market movements in recent months. Both Pfizer and Moderna have been grabbing headlines and it makes sense why. Pfizer and BioNTech’s COVID-19 vaccine candidate is now the first to receive the FDA’s Emergency Use Authorization or EUA. And, Moderna’s mRNA vaccine is expected to be the second one to be granted an EUA, with a decision scheduled for this week.

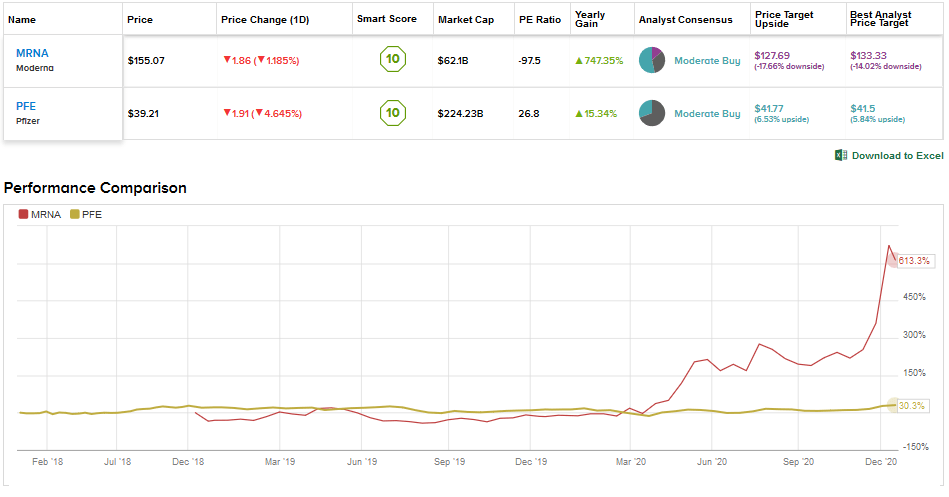

Bearing in mind the lead these companies have in COVID-19 vaccine race, we will use TipRanks’ Stock Comparison tool to stack up Moderna against Pfizer and see which stock is a better pick.

Moderna (MRNA)

Moderna was one of the first companies to start working on a COVID-19 vaccine earlier this year and there has been no looking back. Last month, the company announced that a data analysis indicated that the efficacy of its mRNA-1273 COVID-19 vaccine was 94.1%.

The company is now awaiting a decision on the Emergency Use Authorization of its vaccine candidate by an FDA advisory committee on Dec. 17. Meanwhile, Moderna has entered into supply agreements with several countries aside the US (200 million confirmed vaccine doses for the US alone), including Canada, the UK, EU and Singapore, subject to the approval by regulators.

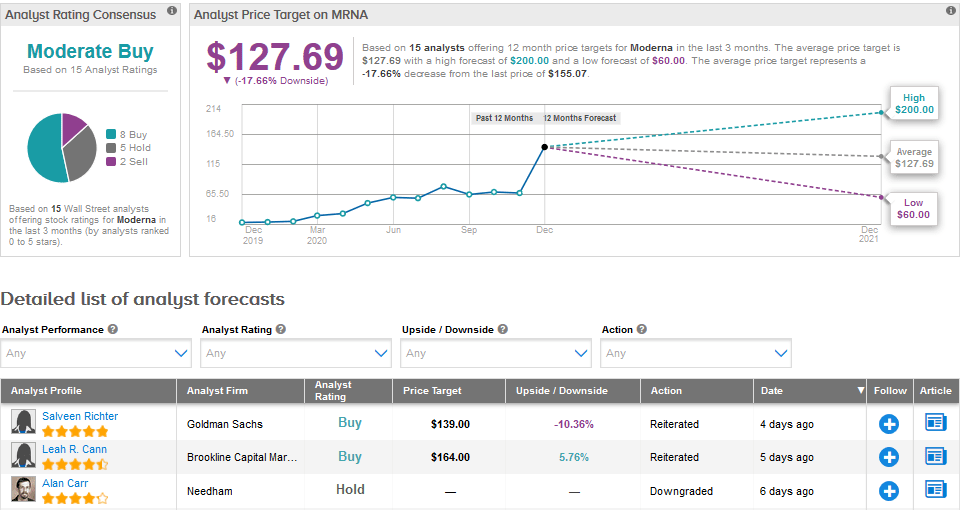

Moderna’s COVID-19 vaccine developments have propelled a 692% rise in its shares year-to-date, and some analysts are now concerned about the company’s valuation. One such analyst is Needham’s Alan Carr, who downgraded Moderna to Hold from Buy last week without providing a specific price target.

Explaining the change in his stance, Carr stated, “Moderna has made significant progress in 2020 towards validation of its mRNA platform, particularly through the discovery and development of COVID-19 vaccine mRNA-1273. The stock has responded remarkably well (+770% YTD, versus +18% for the S&P 500) and we now believe it is fully valued.”

Carr expects Moderna’s vaccine candidate to win the FDA’s Emergency Use Authorization. He assumes the production and sale of 500 million vaccine doses in 2021. While the stock may react favorably to EUA issuance, Carr does not believe that it will justify a meaningfully higher price target. He prefers to “await competitor vaccine updates and additional data from other Moderna programs, which may support a higher valuation.”

So, what has Moderna to offer beyond its potential COVID-19 vaccine? Well, the company’s pipeline has 21 mRNA therapies and vaccines, including four programs in Phase 2. Notably, Moderna’s Cytomegalovirus vaccine showed positive interim Phase 2 data and the company is now preparing for the Phase 3 trial in 2021. (See MRNA stock analysis on TipRanks)

Currently, the Street is cautiously optimistic about Moderna, with 8 Buys, 5 Holds and 2 Sells adding up to a Moderate Buy analyst consensus. Given the meteoric rise in its shares in 2020, the average price target of $127.69 indicates a possible downside of about 18% from current levels.

Pfizer (PFE)

Pfizer and its German partner, BioNTech, achieved a historical milestone when their COVID-19 mRNA vaccine candidate, BNT162b2, was granted the FDA’s Emergency Use Authorization in individuals 16 years of age or older. Both companies are now gathering additional data to file a Biologics License Application with the FDA for a possible full regulatory approval in 2021. Furthermore, Pfizer and BioNTech’s COVID-19 vaccine has also been granted emergency use authorization in the U.K. and Canada as well.

Ahead of the FDA’s EUA, Mizuho Securities analyst Vamil Divan had expressed his optimism about Pfizer’s COVID-19 vaccine being granted an emergency use authorization. Reiterating a Buy rating with a $44 price target, Divan stated, “Pfizer expects to produce up to 1.3 billion doses of the vaccine next year. We currently give them credit for the >450 million doses that they have already agreed to supply to certain developed countries, but see room for significant upside to our sales and EPS estimates should the vaccine rollout goes as planned.”

Divan believes that vaccine sales and cash would provide Pfizer with additional options to pursue acquisitions or licensing opportunities, as well as to return cash to shareholders. “The speed with which Pfizer has moved to develop this vaccine candidate is also encouraging to us, and suggests Pfizer may be able to meet its stated objectives of being a faster-moving, more nimble biopharmaceutical company now that the sale of their Upjohn division has been completed,” summarized Divan.

Indeed, Pfizer seems to be in a better position following the spin-off of its generics business–Upjohn, which the company has combined with Mylan N.V. to form a joint venture called Viatris. Upjohn had long been a drag on Pfizer’s business and one of the reasons for the company’s lackluster performance in recent years.

Pfizer already has several approved drugs, which are generating strong revenue, including blockbuster drugs like breast cancer therapy Ibrance, blood thinner Eliquis and the Prevnar 13 pneumococcal vaccine. Its portfolio also includes many rapidly growing medicines like the rare heart disease drug Vyndaqel.

Pfizer’s growth prospects look strong based on its extensive pipeline of 92 programs (as of October end), including 21 in Phase 3 and 6 in the registration stage. (See PFE stock analysis on TipRanks)

Overall, Pfizer scores a Moderate Buy analyst consensus based on 4 Buys versus 9 Holds. The average price target stands at $41.77, reflecting an upside potential of 6.5% in the months ahead. Shares have risen 5.6% so far in 2020.

Conclusion

Moderna’s breakthrough with the potential COVID-19 vaccine and its pipeline look promising. That said, Pfizer is an established player with an extensive pipeline, blockbuster drugs and access to growing markets. What’s more, Pfizer pays a dividend of $0.37 and has a dividend yield of 3.79%. To summarize, Pfizer appears to be a better pick given its diversified product portfolio, attractive dividend yield and Moderna’s current sky high valuation.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment