It seems Microsoft (NASDAQ:MSFT) has another winner on its hands with ChatGPT. Microsoft may not be an AI stock in the fullest sense—yet—but ChatGPT certainly looks like it will be another leg in the stool of Microsoft’s profitability, eventually. As use is on the rise, so too are businesses considering their response to this growing trend. ChatGPT is gaining popularity at the corporate level, based on a study from Reuters/Ipsos.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It found that 28% of respondents “regularly” used ChatGPT at work, and 22% noted that their companies specifically allowed for the technology to be put to work. Indeed, out at Match.com (NASDAQ:MTCH), ChatGPT is commonly used for “harmless tasks” like putting together emails or “general research.” Other companies are engaged in similar uses, with a few variations in the theme.

However, with 28% “regularly” using ChatGPT at work, it’s easy to wonder what the stance is for the remaining 72%. And in some cases, the stance is “banned outright.” A ZDNET study noted that 75% of businesses are either implementing bans or considering bans on ChatGPT at work. This is likely a bit of good news for everyone who thought that AI would steal their jobs out from under them, but it’s just as easy to wonder how long such a ban will hold up against the potential productivity gains. Of course, with the cautionary tale of Steven A. Schwartz—sometimes called “The ChatGPT Lawyer”—ringing in ears all over, a certain amount of caution is called for.

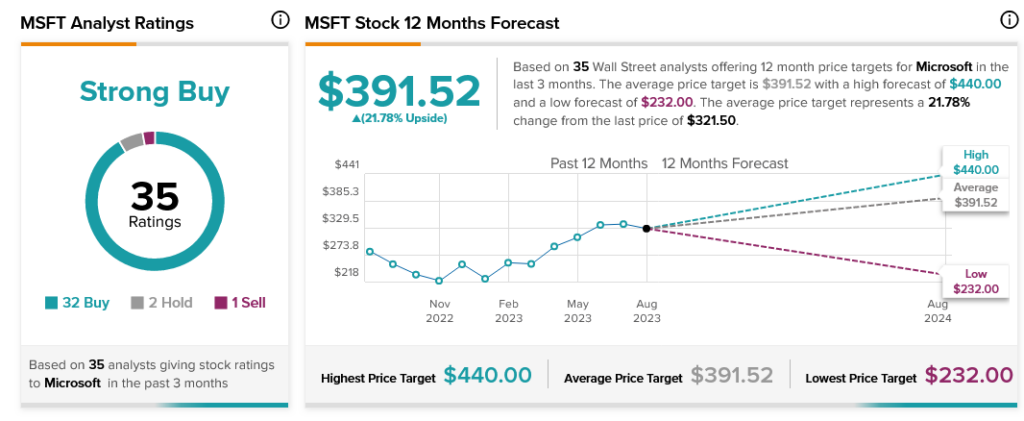

Still, Microsoft is a winner with analysts. With 32 Buy ratings, two Hold, and one Sell, Microsoft stock is considered a Strong Buy by analyst consensus reckoning. Further, with an average price target of $391.52, Microsoft stock comes with a 21.78% upside potential.