Discord is no longer looking to be acquired by Microsoft. A Wall Street Journal report indicates that the free online platform for chatting by text, audio and video has shifted its attention to carrying out an Initial Public Offering (IPO).

Microsoft (MSFT) was rumored to be interested in acquiring the social networking company in a deal believed to be worth $10 billion. Talks ended without the two reaching a deal. However, there is still a possibility that they could come back to the negotiating table in the future, according to the WSJ.

While Discord has attracted interest from three companies, it is also looking at the possibility of staying independent, according to the WSJ report. Last year, the company saw its monthly user base more than double to about 140 million and generated $130 million in revenue, up from $45 million in 2019.

On the other hand, Microsoft has been on the hunt for acquisitions as it looks to expand its empire and strengthen its consumer base. The WSJ reported that last year, it was in the running to acquire parts of the embattled viral video app TikTok. A deal for Discord would allow the software giant to expand its footprint into the social networking space beyond LinkedIn Corp.

Microsoft is in the process of acquiring Nuance Communications (NUAN) in a deal believed to be worth $19.7 billion, to strengthen its foothold in the healthcare space. It has also spent $7.5 billion on Zenimax Media.

Microsoft shares are up 16% year to date after a 29% pop in 2020. (See Microsoft stock analysis on TipRanks)

According to Wedbush’s analyst Daniel Ives, the Nuance Communications acquisition is of great importance as it will double down on Microsoft’s healthcare initiatives.

“The Nuance deal is a strategic no brainer in our opinion for MSFT and fits like a glove into its healthcare endeavors at a time in which hospitals and doctors are embracing next generation AI capabilities from thought leaders such as Nuance” Ives wrote in a research note to investors.

Ives has since reiterated a Buy rating on Microsoft with a $300 price target implying 16.3% upside potential to current levels.

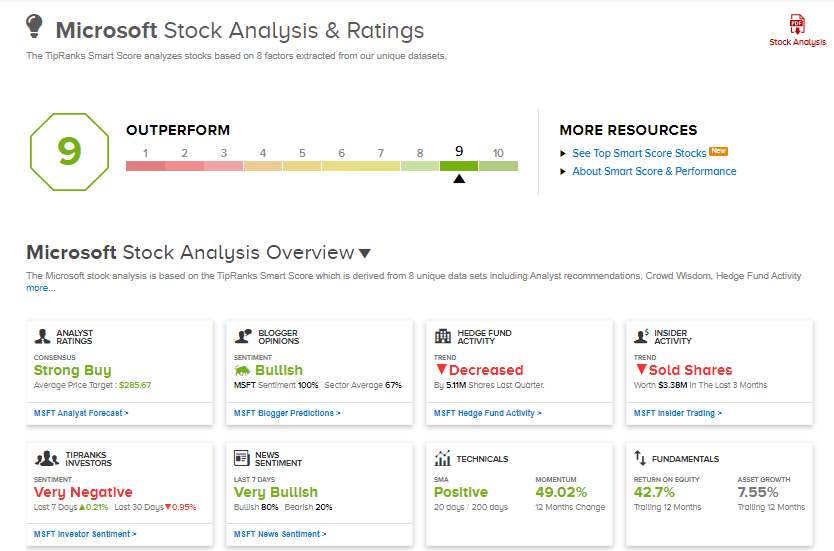

Microsoft commands a Strong Buy Consensus rating on Wall Street based on 22 unanimous Buy recommendations. The average analyst price target of $285.67 implies 9.63% upside potential to current levels.

MSFT scores a 9 out of 10 on TipRanks’ Smart Score rating system, which indicates that the stock is likely to outperform market expectations.

Related News

Netflix Growth In New Subscribers Slows; Shares Plunge 7%

Amazon Trials Latest Industry Technology In New Salon In London

IBM Delivers Impressive 1Q Results; Hybrid Cloud Platform Adoption Shines