Tech giant Microsoft (NASDAQ:MSFT) has made plenty of advances in artificial intelligence, and not just backing OpenAI. It’s made several of its own as well, and new reports have emerged about just how powerful its own latest development, Phi-2, actually is. Investors, for their part, were modestly impressed and sent shares up fractionally in the closing minutes of Tuesday’s trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Microsoft started out heavy, revealing that Phi-2 was not only suitable to run on several devices but was also strong enough to take on—and beat—several competitors’ models. For instance, Microsoft specifically noted that it could take on Meta Platforms’ (NASDAQ:META) AI and outperform it. Further, Microsoft revealed that Phi-2 used 2.7 billion parameters, which was enough for it to beat both Mistral and Llama-2 using a series of “aggregated benchmarks.” Phi-2 was even sufficient to tackle Google (NASDAQ:GOOG) (NASDAQ:GOOGL) and its Gemini Nano 2, even though Phi-2 wasn’t a match for Nano 2’s size.

But Will AI Take Our Jobs?

Microsoft, perhaps realizing that unfettered access to AI might ultimately result in a string of industries altered to the point they no longer need human employees, decided to head off those potential issues by setting up partnerships with labor groups. The partnerships are intended to offer information about trending technology in AI, as well as using “worker perspectives and expertise” in the building of AI technology. Though many are likely still skeptical—and no “labor partnership” will ever fix that—the move could be seen as positive for Microsoft.

What is the Target Price for Microsoft Stock?

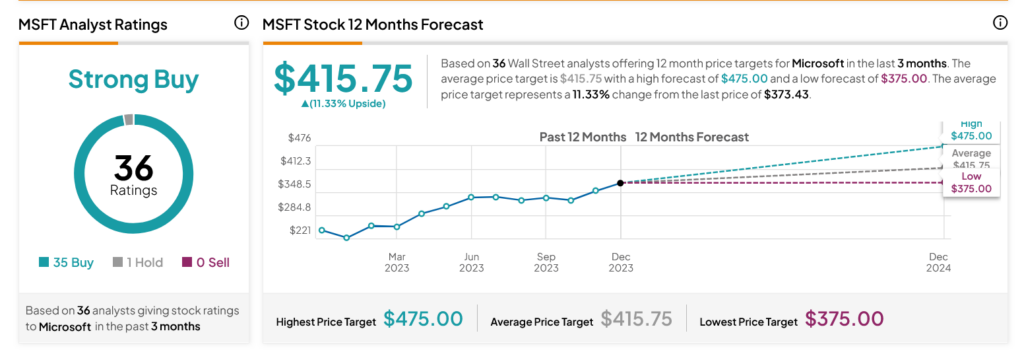

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 35 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 46.32% rally in its share price over the past year, the average MSFT price target of $415.75 per share implies 11.33% upside potential.