Tech giant Microsoft (NASDAQ:MSFT), known just as much for its cloud data functions as its video gaming operations and, of course, its PC operating system, slipped fractionally in Thursday afternoon’s trading after announcing a major new plan for the European Union. The plan involves Microsoft opening up data storage operations for the European Union, at least those parts of it that already subscribe to Microsoft’s cloud services.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

After the EU brought out its latest round of privacy and security laws, several tech companies started opening up their operations and giving Europeans access to personal data storage and processing operations. Amazon (NASDAQ:AMZN), for its part, offered such services back in October. Microsoft, meanwhile, previously allowed the storage of some data but is now ramping up that access.

A Major New Milestone

Microsoft’s move to seize new business comes at a very exciting time for it: the company recently announced that, for at least a while in Thursday morning’s trading session, it was briefly the most valuable company on the face of the Earth. It surpassed Apple (NASDAQ:AAPL) thanks to a combination of factors, including a pullback in Apple stock and a rally for Microsoft stock, as it picked up new investments with several developments in artificial intelligence. With Apple seeing a revenue decline thanks to slowing iPhone sales right at the same time Microsoft is picking up steam, that was enough to narrow the gap significantly.

What is the Price Target of Microsoft Stock?

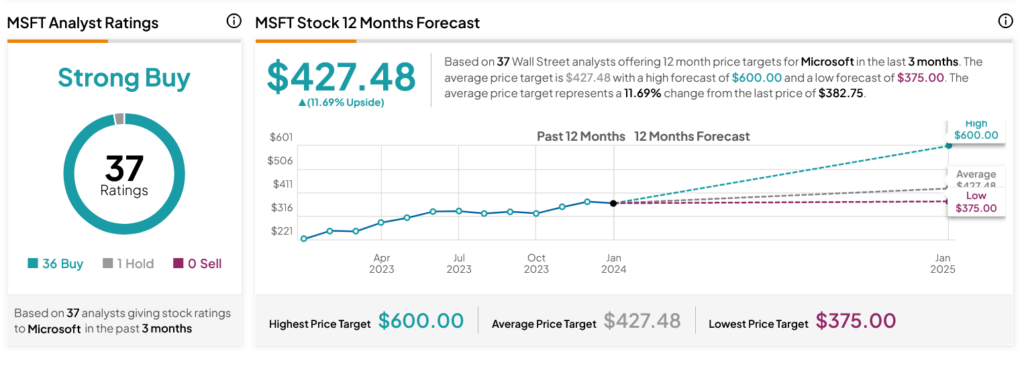

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 36 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 61.62% rally in its share price over the past year, the average MSFT price target of $427.48 per share implies 11.69% upside potential.