Microsoft (NASDAQ:MSFT) is way behind Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG)-owned Google in the Search and digital ad businesses. The company is finding it tough to take share from Google, the Wall Street Journal reported. Per the report, MSFT’s Bing, its web search engine, has not been able to cut into Google’s share despite the integration of AI (artificial intelligence)-powered features.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Microsoft sparked excitement when it integrated ChatGPT into Bing to test paid advertising links in chat results earlier this year. Moreover, it also introduced new AI-powered features to Bing. Despite these efforts being aimed at growing its share in Search and boosting digital advertising, the company has not yet witnessed any meaningful results.

Bing is the default search experience for OpenAI’s ChatGPT. Further, it is expanding its ad network to new markets spanning across Search, display, media, video, native, retail, and connected TV. However, the report highlighted that Bing had a 3% market share worldwide in Search, which has remained flat since the beginning of this year. In addition, monthly visitors at Bing were about 1% of Google’s monthly visitors in July.

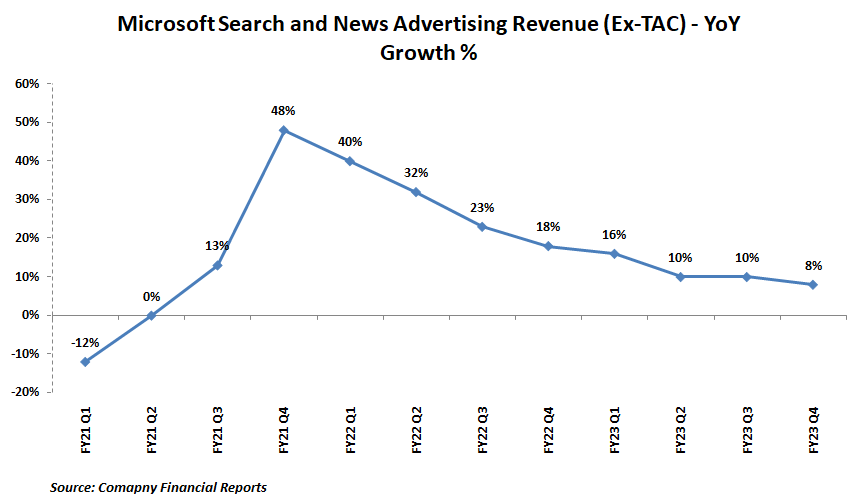

Notably, the company’s Search and News advertising revenue growth has consistently moderated (see the graph below) despite the introduction of AI.

As Microsoft is lagging behind Google in Search and digital ad business by miles, let’s look at what the Street recommends for its stock.

Is Microsoft a Buy or a Sell Now?

As Search is not a significant portion of MSFT’s business, Wall Street analysts maintain a bullish stance on its shares despite lagging behind Google. On the other hand, its integration of AI into products and services, expected reacceleration in the Cloud business, and strong balance sheet and cash flows position it well to deliver solid growth in the coming years.

With 32 Buy, two Hold, and one Sell recommendations, Microsoft stock has a Strong Buy consensus rating on TipRanks. At the same time, analysts’ average price target of $391.52 implies 23.55% upside potential from current levels.