Microsoft (NASDAQ:MSFT) can’t readily be pigeonholed as a company. It got its start offering software, but it quickly branched out into a range of territories from gaming to cloud-based systems to artificial intelligence (AI). In fact, according to word from Piper Sandler, those non-cloud assets may be putting a little something extra in the guidance to come. Microsoft budged up fractionally on the news in Monday morning’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Piper Sandler, via analyst Brent Bracelin, noted that Microsoft’s cloud presence is definitely a major part of its operations right now, but the non-cloud parts can’t be readily forgotten. In fact, Microsoft—Bracelin noted—could see non-cloud operations represent as much as 47% of its overall sales. Further, Microsoft’s non-cloud operations have been on the rise in recent months, with Bracelin noting that the Microsoft Envision event last week offered up enough evidence to confirm Piper Sandler’s “bullish view” on its AI operations and beyond. Investors may be focused on Azure, Bracelin concludes, but there’s a lot more to Microsoft than that.

Indeed, Microsoft proved as much with another recent piece of news; it’s planning to invest $3.16 billion in Australia, focusing on three key points: cloud computing, of course, but also artificial intelligence infrastructure and cybersecurity. Microsoft plans to lay out the investment over a two-year period, during which time it will grow its available data center access by 45% across three major locations.

What is Microsoft’s Target Price?

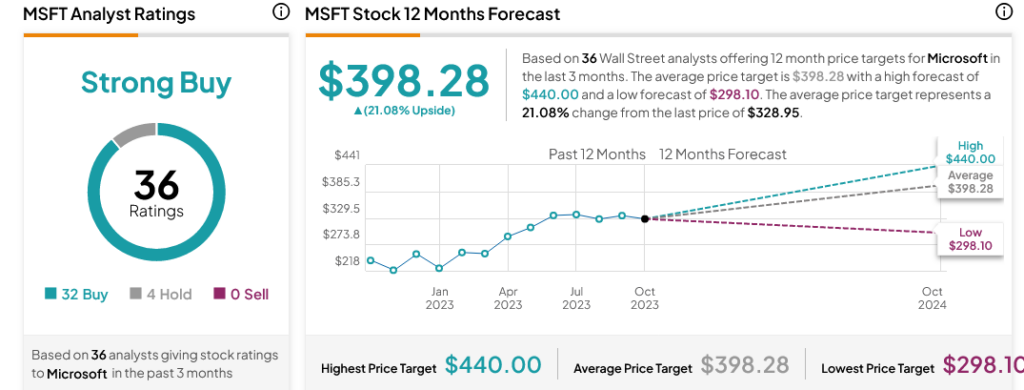

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 32 Buys and four Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average MSFT price target of $398.28 per share implies 21.08% upside potential.