Shares of American technology giants Microsoft Corporation (MSFT) and Alphabet Inc. Class A (GOOGL) has fallen the most in the past week, since the start of the pandemic.

One of the top metaverse stocks, MSFT declined 6.4% and GOOGL lost more than 5% in the first week of trading for the new year 2022. This has been the largest weekly slump for both companies since March 2020.

Rising Treasury Bond Yields

The yield on the U.S. 10-year Treasury bonds increased to 1.77% on Friday, its highest level since January 2020. The upward spike caused high growth stocks, especially technology stocks, to fall.

An increasing yield indicates an inflationary environment, which means companies will face higher borrowing costs to fund development. From the investor’s perspective, a rising yield means they expect more returns on their investments. Both factors add pressure to the performance of high-growth companies.

Another factor that led to the overall downfall was the latest jobs report, which showed a slump in the unemployment rate as well as an increase in wages.

On Friday, MSFT sank by as much as 1.2% and GOOGL fell 1.4%. The iShares Expanded Tech-Software Sector ETF also slipped as much as 1.7% on Friday, and for the past week it was down 8.7%.

2021 was a favorable year for the tech sectors as the pandemic-driven shifts led to major spending on tech services. Microsoft gained 45.6% over the past year and Alphabet gained 56%. Meanwhile, the tech-laden NASDAQ 100 gained about 25% last year.

Analysts’ Weigh In

Recently, Wedbush analyst Daniel Ives issued a report about the upcoming earnings season for the disruptive technology stocks. The analyst says the Street is laser-focused on the stocks’ 2022 guidance.

Ives said, “In this vacuum of Fed news and watching every tick of the 10-year yield move on an hourly basis, tech investors wish 4Q earnings season was already here today. The absence of fundamental news for the tech space in this risk-off environment has catalyzed a brutal surge of selling tech names to kick the year off in 2022 as valuation scrutiny remains front and center for investors.”

Microsoft remains his favorite large-cap stock. Ives has a Buy rating on the stock and a price target of $375, which implies 19.4% upside potential to current levels.

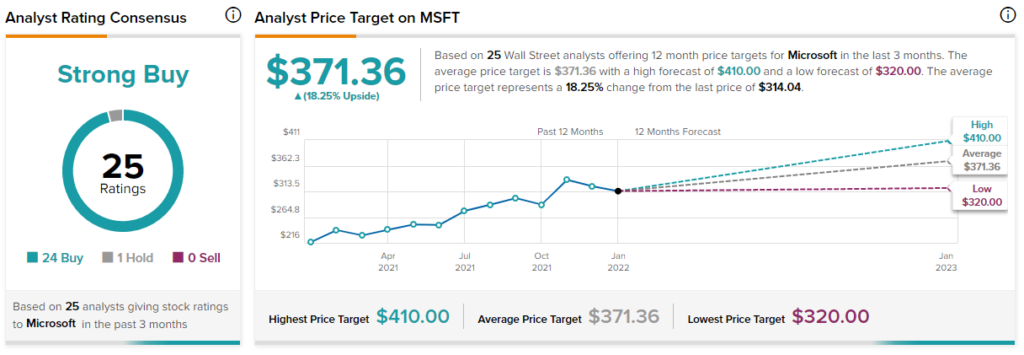

Overall, the MSFT stock commands a Strong Buy consensus rating based on 24 Buys and 1 Hold. The average Microsoft price target of $371.36 implies 18.3% upside potential to current levels.

Download the TipRanks mobile app now

Related News:

Bed Bath & Beyond Misses Q3 Expectations; Meme Frenzy Drives the Shares Up

Nikola Signs LOI with Saia; Shares Soar Above 9%

Uber to Stop Uber Eats Restaurant Delivery in Brazil