In a recent filing with the Securities and Exchange Commission (SEC), Montana-based investment management services provider Allied Investment Advisors stated that it increased its stake in Microsoft Corp. (NASDAQ: MSFT) by 2.8% or 1,629 shares in the first quarter of 2022. The company now owns 58,917 shares or 5.9% stake in the software firm.

The 5.9% stake in Microsoft was worth almost $18.2 million at the end of the first quarter and captured the second biggest position in Allied Investment’s portfolio.

Q4 Expectation

The Washington-based tech giant is expected to announce its fiscal fourth-quarter results next month. The Street anticipates earnings to come in at $2.31 per share, compared to $2.17 per share last year and $2.22 per share in the third quarter.

Price Target

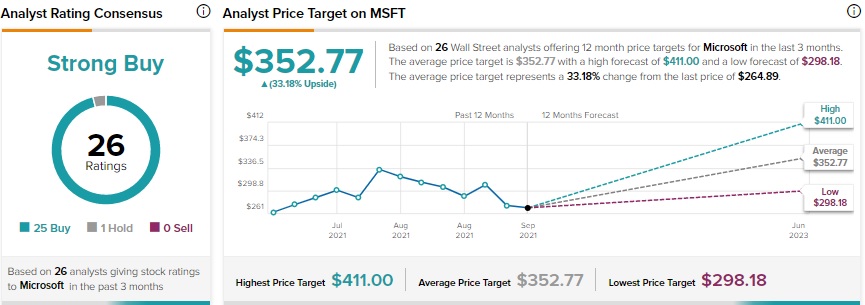

Based on 25 Buys and one Hold, the stock has a Strong Buy consensus rating. MSFT’s average price target of $352.77 implies 33.2% upside potential from current levels. Shares have lost 22% over the past six months.

Bloggers’ Sentiment

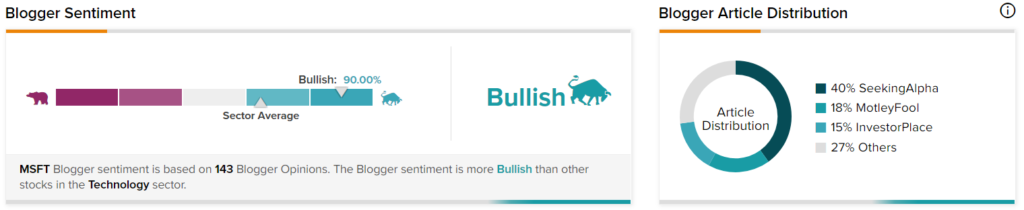

TipRanks data shows that financial bloggers are 90% Bullish on MSFT, compared to the sector average of 65%.

Conclusion

With a market cap of almost $2 trillion, Microsoft is one of the biggest tech companies in the world. The 22% decline in the stock price over the last six months could be an opportunity for investors interested in MSFT stock.

Read full Disclosure