The chip stock space has been a bit rough lately. All the ups and downs prompted by wild swings in supply and demand have driven the memory market into rough territory. Just look at Micron Technology (NASDAQ:MU), which slipped over 2% in Thursday afternoon’s trading despite some new positive sentiment coming out around

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The word from analyst Matt Bryson from Wedbush Securities was at least cautiously optimistic for Micron. There were, after all, “…still areas of weakness in the memory sector,” Bryson noted. He pointed to hyperscale demand in particular but also to handsets and PC end users, both of which were hovering around the lower end of the scale. But there were some positive notes to Micron’s last quarter that made Bryson think that some margin improvements should come around. Plus, it would also pave the way for better conditions in the first quarter of 2024.

Such news comes at an excellent time, too; Micron is poised to break ground on a new factory in India. Expected to be operational by late 2024, it’s still going to represent plenty of expenses without a boost in revenue to help offset them. If the market recovers more fully in late 2024, as Bryson seems to suggest, then Micron’s new factory will be online at just the right time. If not, however, it could represent a pricey new albatross around Micron’s collective neck.

Is Micron a Buy, Sell, Or Hold?

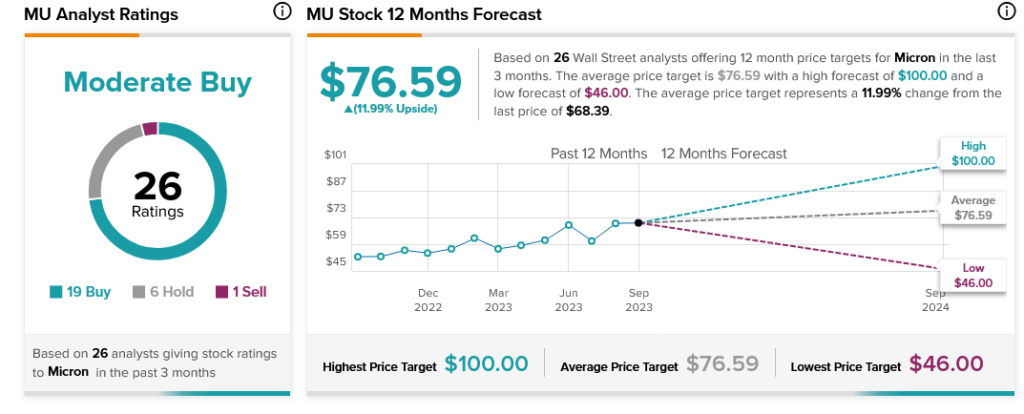

Analysts, meanwhile, have a little more faith here. With 19 Buy ratings, six Holds, and one Sell, Micron Technologies stock is considered a Moderate Buy. Further, with an average price target of $76.59, Micron Technologies stock also offers 12% upside potential.