Shares of Micron Technology (NASDAQ: MU) plunged as much as 7.2% in the extended trading session on Thursday after the company reported better-than-expected fiscal third-quarter results but gave a sluggish outlook for the fourth quarter. MU stock was down 3.7% in pre-market trading on Friday at the time of writing.

Micron Technology manufactures and sells computer memory and computer data storage solutions like flash memory, random-access memory, and USB flash drives. MU stock has lost 42.2% so far this year amid the broader tech sell-off.

Micron and its competitors witnessed accelerated demand for their products during the COVID-19 pandemic owing to the work-from-home trend. Additionally, chip shortages and supply chain issues led to a further ballooning of demand for these products.

However, as the pandemic receded, slowing consumer demand for personal computers and smartphones, and the recent lockdowns in China, hampered the company’s sales. Moreover, the softening demand momentum also resulted in excess inventory at cloud customers which impacted Micron’s business on both the demand and supply side.

Rising inflation and increasing interest rates are further dragging down the overall consumer spending.

Commenting on the same, MU’s President and CEO Sanjay Mehrotra said, “Recently, the industry demand environment has weakened, and we are taking action to moderate our supply growth in fiscal 2023. We are confident about the long-term secular demand for memory and storage and are well-positioned to deliver strong cross-cycle financial performance.”

Results in Detail

Micron reported adjusted earnings of $2.59 per share, 15 cents higher than analysts’ estimates and significantly higher than the prior year’s figure of $1.88 per share.

Furthermore, revenues rose 16.4% year-over-year to $8.64 billion, coming in line with Street’s estimates.

Notably, the company repurchased $981 million worth of common stock during the quarter, thereby reducing its outstanding shares by 13.8 million. Moreover, the Board of Directors declared a quarterly cash dividend of $0.115 per share, payable on July 26, 2022, to shareholders of record on July 11, 2022.

Q4 Outlook

Due to the ongoing macroeconomic uncertainty and the expected muted demand for its offerings, Micron guided sluggish growth for Q4.

The company expects Q4 revenue to fall between $6.8 billion and $7.6 billion, while the consensus is pegged much higher at $9.13 billion. Similarly, adjusted earnings are projected to fall in the range of $1.43 to $1.83 per share, much lower than the consensus estimate of $2.6 per share.

Analysts Weigh In

Reacting to MU’s Q3 results and Q4 outlook, Mizuho Securities analyst Vijay Rakesh slashed the price target on the stock to $84 (51.9% upside potential) from $95 while maintaining a Buy rating.

Rakesh is concerned with MU’s view that the industry inventory might take a “couple of quarters into F23E” to normalize, which means that the current headwinds could continue to impact its “top-line/margins in the near-term.”

Likewise, Robert W. Baird analyst Tristan Gerra lowered the price target on MU stock to $60 (8.5% upside potential) while maintaining a Hold rating.

The analyst believes that Micron’s over-dependence on the PC/smartphone/consumer-led markets could lead to a worse slowdown for the company compared to the overall semiconductor market.

Gerra noted, “With PC units expected to be flat to down next year, smartphone growth to remain muted due to high 5G adoption rates, along with a YoY growth slowdown in data center, MU shares could trade sideways for quite some time despite the low multiple, in our view.”

Even Piper Sandler (NYSE: PIPR) analyst Harsh Kumar significantly slashed the price target on MU stock to $50 (9.6% downside potential) from $70 while maintaining a Sell rating.

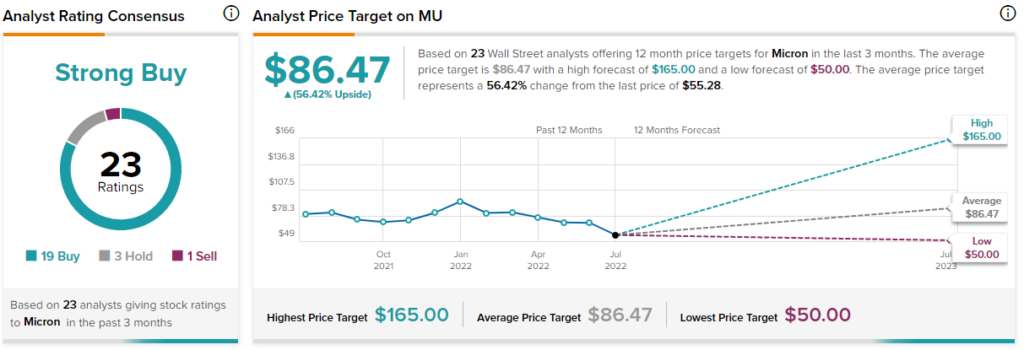

Despite the current negativity, MU stock still commands a Strong Buy consensus rating based on 19 Buys, three Holds, and one Sell. The average Micron Technologies price target of $86.47 implies 56.4% upside potential to current levels.

Concluding Notes

Micron Technologies is facing one of the worst times after witnessing peak demand during the COVID-19 pandemic. However, both management and Wall Street are optimistic about the robust long-term trends in the end market. Moreover, according to the TipRanks Smart Score system, Micron Technology scores a seven, which means the company is likely to perform in line with market expectations.