Shares of Micron Technology plunged 3.9% in Tuesday’s extended trading session after the memory chip maker issued 1Q guidance that fell short of analysts’ expectations.

For 1Q, Micron (MU) expects revenues and adjusted EPS of $5.2 billion (+/- $200 million) and $0.47 (+/- $0.07), respectively. Wall Street analysts had expected sales and earnings of $5.44 billion and $0.73 per share, respectively.

For 4Q, the company reported strong results. Adjusted EPS increased nearly 93% to $1.08 year-over-year, beating Street consensus of $0.99. Sales of $6.06 billion during the reported period surpassed analysts’ expectations of $5.89 billion and marked a year-over-year improvement of 24.4%. Micron’s 4Q results mainly benefited from strong memory chip demand.

Micron’s CEO Sanjay Mehrotra said that the company “delivered solid fiscal fourth quarter revenue and EPS resulting from strong DRAM (Dynamic Random-Access Memory) sales in cloud, PC and gaming consoles and an extraordinary increase in QLC (Quad-level cell) NAND shipments.” Mehrotra sees “improving market conditions throughout calendar 2021, driven by 5G, cloud and automotive growth, and we are excited by the continued momentum in our product portfolio.” (See MU stock analysis on TipRanks)

Following its quarterly results, Mizuho Securities analyst Vijay Rakesh reduced the stock’s price target to $56 (10.4% upside potential) from $58 citing Micron’s soft guidance for 1Q. Rakesh pointed out that the company’s dismal 1Q outlook reflects loss of revenues from sales to China’s Huawei Technologies, increased mix of low-margin NAND products, and “weaker enterprise with higher inventory levels and pricing trends.” Nonetheless, the analyst reiterated his Buy rating citing Micron’s strong underlying fundamentals.

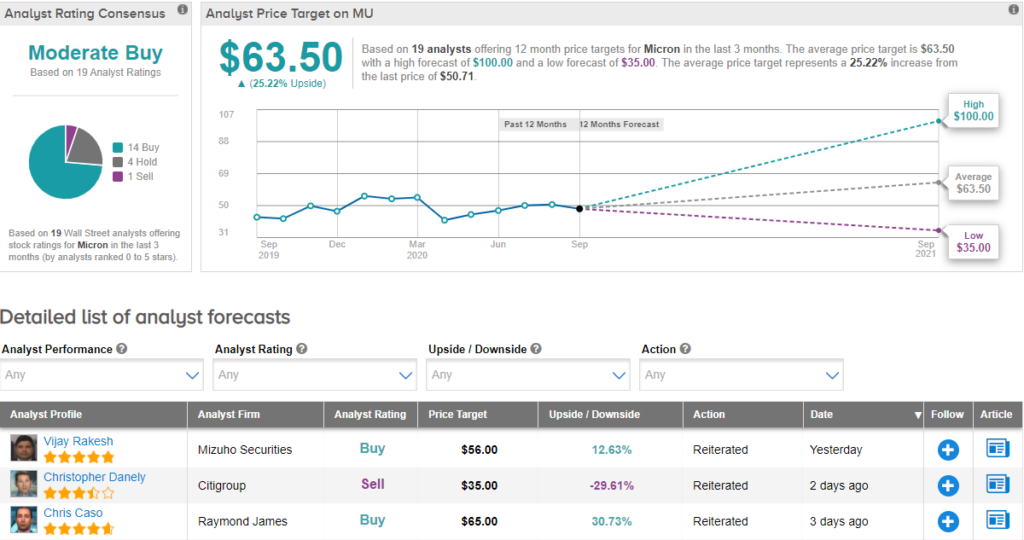

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 14 Buys, 4 Holds and 1 Sell. With shares down 5.7% year-to-date, the average price target of $63.50 implies upside potential of about 25.2% to current levels.

Related News:

MobileIron Jumps 6.2% On $872M Buyout From Ivanti

Juniper To Buy Netrounds; Street Says Hold

Guggenheim Upgrades Spotify To Hold, Lifts PT