MGM Resorts continues to try to move into online gambling and according to the Wall Street Journal, has made another offer to buy Entain plc, a UK-based sports betting and gambling group that operates both online and in the retail sector.

MGM (MGM) recently failed to acquire Entain with a $10 billion all-cash offer and details of the latest offer are not known at this time. Neither MGM nor Entain have responded to any requests for comments.

Entain owns bookmaker Ladbrokes, as well as a comprehensive portfolio of established sporting and online casino brands, including bwin and partypoker.

MGM already has a joint venture with Entain in the US called BetMGM, which was created to capitalize on opportunities that the regulation of sports betting and gaming presented.

The COVID-19 pandemic has forced gambling groups to revise their business models as travel restrictions and lockdowns have affected the brick-and-mortar casino industry.

Gambling hubs like Las Vegas and Macau were hard hit by the pandemic and saw earnings figures fall significantly and unemployment rates skyrocket. MGM laid off 18,000 furloughed employees in the US last August and the Vegas unemployment rate remains well above the US average.

Online gambling companies alternately benefitted as gamblers around the world were forced to move their gambling online. This change in behavior has forced casino operators to take a closer look at offering their patrons online options. (See MGM stock analysis on TipRanks)

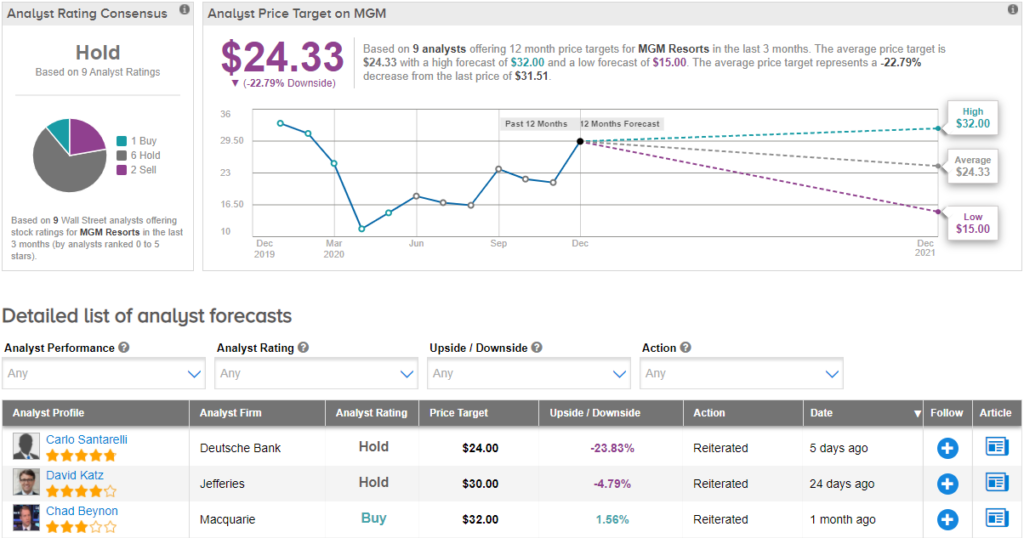

Jefferies analyst David Katz recently reiterated his Hold rating on MGM and raised his price target from $22 to $30. This implies downside potential of around 5% from current levels.

Katz stated last week that he believes the tide is shifting in gambling companies’ favor, and that while casinos may traditionally be considered “sin” stocks, opinions have changed. Gambling has spread to 42 states in the US over the past 25 years and often improves the overall economic outlook for a region.

Overall, consensus among analysts is a Hold based on 1 Buy, 6 Holds and 2 Sells. The average price target of $24.33 suggests downside potential of around 23% over the next 12 months.

Related News:

W. R. Berkley To Book $105M Gain From Property Sale; Street Sees 8% Upside

T-Mobile Hit By Second Security Breach In 2020

Nio Finishes 2020 With a 121% Jump in December Deliveries