Meta Platforms (META) has banned RT and other Russian media outlets from its apps, including WhatsApp, Instagram, and Facebook. The U.S. Department of Justice (DOJ) accused RT of “foreign interference” in the upcoming U.S. presidential elections. The DOJ alleged that RT employees funneled roughly $10 million into an American company to showcase pro-Russian content.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

RT is a Russian state-owned media company that is allegedly trying to influence the polls as well as working from a secret hideout. Meta had earlier stopped Russian state media from running advertisements on its platforms. Tenet Media, one of the notable Russian media companies, is also accused of hosting Donald Trump’s supporters to influence the elections. All the pro-Trump commentators on Tenet Media vowed that they were unaware of Russian influence and fell victim to the scheme.

Russia’s Growing Interference in the U.S.

RT has denied any wrongdoing but has failed to prove any of the allegations wrong. RT reportedly amassed a good following on Meta’s platforms, boasting over 7 million users on Facebook and approximately one million followers on Instagram. Among other things, Russian media outlets are also accused of using social media to undertake crowdfunding campaigns to support their military operations in Ukraine.

Tech companies are expected to protect their platforms from any foreign influence and avoid any potential threats to the U.S. elections. Executives from Meta, Microsoft (MSFT), and Alphabet (GOOGL) (GOOG) are set to testify before the Senate Intelligence Committee on September 18, citing their plans to combat any foreign threats to the upcoming elections.

Meta’s Growing Popularity

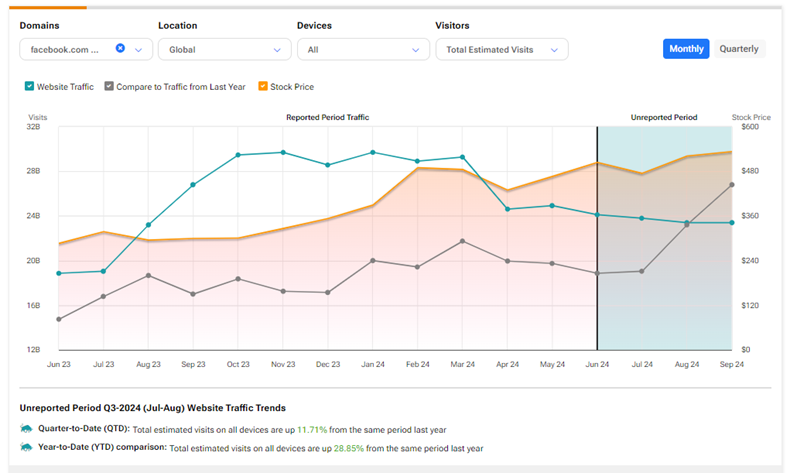

Despite ongoing concerns about misuse of the apps and stiff competition, Meta Platforms boasts a strong line-up of businesses, including its Family of Apps (FoA) and Reality Labs. According to TipRanks’ Website Traffic tool, the total estimated visits to all of Meta’s apps and websites worldwide increased 28.9% year-to-date compared to last year.

Is Meta Stock a Buy?

Wall Street is highly optimistic about Meta stock’s trajectory. On TipRanks, META stock has a Strong Buy consensus rating based on 41 Buys, three Holds, and one Sell rating. Also, the average Meta Platforms price target of $584.82 implies 9.7% upside potential from current levels. Year-to-date, META shares have gained an impressive 51%.