Shares of Meritor, Inc. (MTOR) have gained 14.8% over the past month. The company caters to commercial vehicle and industrial markets via its drivetrain, mobility, braking, electrical powertrain, and aftermarket solutions.

Recently, Meritor announced it will supply Blue Horizon 14Xe ePowertrains to Hexagon Purus. The ePowertrain will be used for two different hydrogen-fuel cell electric vehicle applications, which draws attention from EV stocks.

Additionally, Meritor has also agreed to supply long-haul tandem and single rear-drive axles to Beijing Foton Daimler Automotive (BFDA).

Meritor will also supply zero-emission electric propulsion for the next generation school buses manufactured by Thomas Built Buses (TBB). TBB is a Daimler Trucks North American brand.

Meritor’s upcoming earnings for the first quarter are expected on February 3. Consensus estimates point to earnings per share of $0.63.

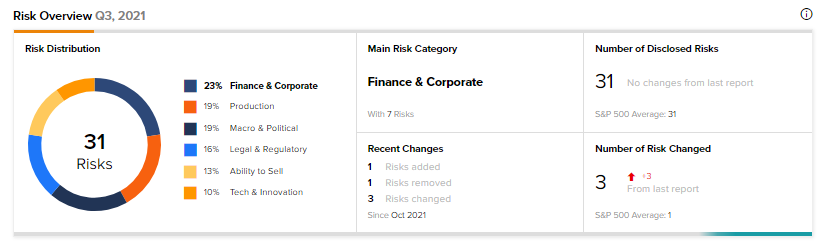

With these developments in mind, let us take a look at the changes in Meritor’s key risk factors that investors should know.

Risk Factors

According to the TipRanks Risk Factors tool, Meritor’s top risk category is Finance & Corporate, contributing 23% (compared to a sector average of 44%) to the total 31 risks identified.

In its recent annual report, the company has added one key risk factor under the Ability to Sell risk category.

Meritor noted that the commercial vehicle market is witnessing substantial technological changes due to a shift towards electrified drivetrains. Consequently, there is higher competition from new market entrants and a need for increased capital to develop new technologies. Meritor’s market competitiveness could be adversely impacted if it is not able to provide products that meet customers’ requirements.

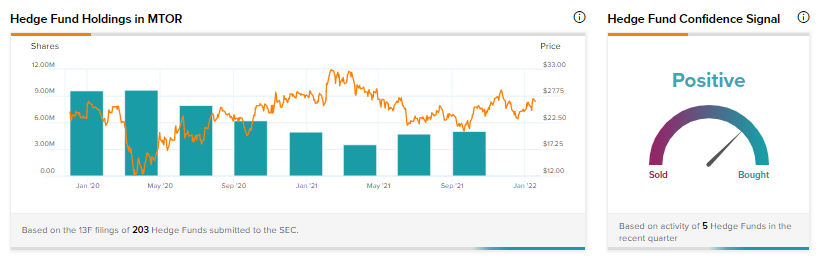

Hedge Fund Activity

According to TipRanks data, the Wall Street’s top hedge funds have increased holdings in Meritor by 344 thousand shares in the last quarter, indicating a positive hedge fund confidence signal in the stock based on activities of five hedge funds in the recent quarter.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Rio Tinto Reports Disappointing Production Results

AWS & TD Synnex Collaborates to Enhance Digital Offerings

Caesars Partners with Buffalo Bills; Street Says Buy