American multinational pharmaceutical company Merck (NYSE: MRK) has posted better-than-expected results for the fourth quarter of 2021 on strong sales of its COVID-19 antiviral Molnupiravir. Meanwhile, the company provided disappointing earnings guidance for 2022.

Following the news, shares of the company declined 3.7% to close at $79.01 on Thursday.

Results in Detail

Merck recorded adjusted earnings of $1.80 per share, topping the consensus estimate of $1.56 per share. The company reported earnings of $0.98 per share in the prior-year quarter.

Total sales generated in the quarter stood at $13.5 billion, up 24% year-over-year, and beat the Street’s estimate of $13.46 billion.

Merck reported robust commercial results across its pipeline, including KEYTRUDA (pembrolizumab), GARDASIL [Human Papillomavirus Quadrivalent (Types 6,11,16 and 18) Vaccine, Recombinant], GARDASIL 9 (Human Papillomavirus 9-valent Vaccine, Recombinant), and Animal Health.

On a segment basis, total pharmaceutical sales grew 23% year-over-year to $12 billion, driven by molnupiravir sales and growth in oncology, vaccines, and hospital acute care products. Markedly, Molnupiravir sales stood at $952 million in the quarter, generated mainly in the U.S., the U.K., and Japan.

Additionally, sales at Animal Health were $1.3 billion, up 8%, reflecting growth across geographies and species.

Gross margin stood at 71.4%, compared with 54.1% in the same quarter last year. Meanwhile, selling, general, and administrative (SG&A) expenses grew 8% to $2.8 billion, while research and development (R&D) expenses were $3.1 billion, down 46.6%.

For 2021, Merck reported adjusted earnings of $6.02 per share, up 33% year-over-year. Total sales came in at $48.7 billion, up 17%.

Guidance

For 2022, the company expects adjusted EPS in the range of $7.12 to $7.27, lower than the consensus estimate of $7.29 per share.

Additionally, revenue is forecast between $56.1 billion and $57.6 billion, versus analysts’ expectations of $56.64 billion. Notably, expected sales of Molnupiravir are likely to be in the range of $5 billion to $6 billion.

CEO Comments

Looking forward, Merck CEO Robert M. Davis said, “We enter 2022 with strong momentum and are moving with speed to bring forward innovations that address critical unmet needs and contribute to global health. This remains at the core of our strategy, and why we are focused on benefitting the patients we serve, and in turn creating long-term value for our shareholders.”

Analyst Recommendations

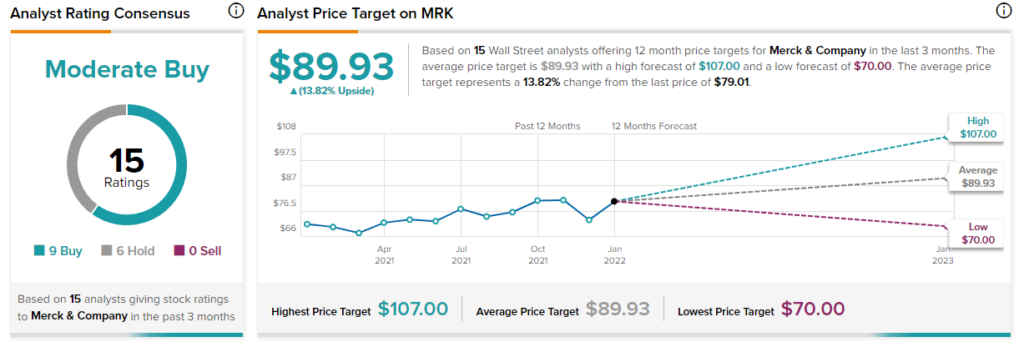

Following the fourth-quarter results, BMO Capital analyst Evan David Seigerman maintained a Hold rating and a price target of $87 (10.11% upside potential).

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 9 Buys and 6 Holds. The average Merck price target of $89.93 implies 13.82% upside potential. Shares have gained 5.9% over the past year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Meta’s Q4 Earnings & Q1 Revenue Guidance Disappoint; Shares Plunge 23%

Allstate Q4 Earnings & Revenue Beat Expectations

Ford to Accelerate Investments by $20B in EV Push?