Medtronic Plc raised its quarterly cash dividend by 7% ahead of the release of the medical device maker’s fiscal first-quarter results on Tuesday.

Medtronic (MDT) said that its board of directors on Friday approved the fiscal year 2021 second-quarter dividend of $0.58 per ordinary share, representing a 7% increase over the prior year. The dividend is payable on October 16 to shareholders of record at the close of business on September 25. Shares rose 1.4% to $100.10 in early afternoon trading.

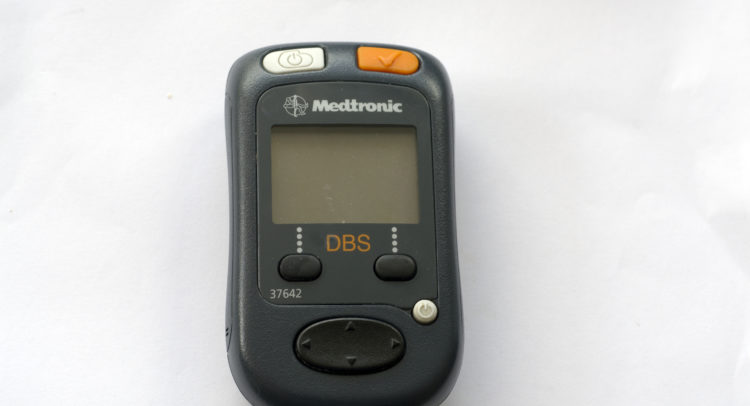

Medtronic, which is a member of the S&P 500 Dividend Aristocrats index, has increased its annual dividend payment for the past 43 consecutive years. The medical device maker employs more than 90,000 people worldwide, serving physicians, hospitals and patients in more than 150 countries.

The company will report its first-quarter earnings for fiscal 2021 on August 25.

Medtronic shares have been hard hit dropping 12% on a year-to-date basis as many hospitals that use its medical devices deferred elective procedures due to the coronavirus pandemic. (See Medtronic stock analysis on TipRanks).

Ahead of the financial results, Cohen & Co. analyst Josh Jennings last week reiterated a Buy rating on the stock with a $110 price target. saying shares should benefit from the company’s fiscal calendar in F1Q’21.

Jennings expects results to reflect strong elective procedure recovery trends. The analyst believes that Street models do not fully account for the month-on-month improvements experienced from May through July.

“The extra selling week [in April] dynamic provides us with confidence that MDT’s business units performed at a similar level to competitors who have already reported C2Q’20 results,” Jennings wrote in a note to investors. “The Street’s revenue and EPS estimates of $5.4B (-27% cc) and $0.15 appear conservative compared to our revised forecasts of $6.2B (-15.8% cc) and $0.40.”

The rest of the Street shares Jennings’ bullish outlook on the stock. The Strong Buy analyst consensus boasts 8 Buy ratings versus 1 Hold rating. The $112.17 average analyst price target implies 12% upside potential in the shares over the coming year.

Related News:

Lowe’s Hikes Quarterly Cash Dividend By 9% After 2Q Surprises Investors

AstraZeneca Rises On Report Trump Could Fast-Track Covid-19 Vaccine Candidate

AstraZeneca Receives Russian Nod For Covid-19 Vaccine Trial- Report